(I'm still working on uploading video from last night's candidates' forum to the Madville Times YouTube channel. I'll post, embed, and comment on those videos as soon as the whole collection is up!)

I'd like to connect two seemingly disparate issues: bridges and our high school. (I don't think this would have fit in our two-minute speeches last night. I beg your indulgence.)

School board candidate Jennie Thompson accepts the argument that it would be cheaper to do all of the proposed renovations and additions to our high school at once. I'm inclined to agree with her: whatever repairs and upgrades the high school building needs, however many thousands of seats we want to include in a new luxury gym, all of that would probably be cheaper to build as one package, right now, with one contractor. Doing renovations in phases, with possibly different bidders coming back and coordinating smaller projects in different parts of the building in different years, would likely be less efficient.

I've heard some people compare the situation to renovating your own house. If you're having Bev and Larry Even remodel your kitchen, you can probably save a little money by having them redo the dining room while they're at it rather than waiting and asking them to come back next year and set up shop in your house a second time.

But with the high school, we're not just talking adding some nice cabinets and pretty tile. We're talking about avoiding the immolation of our precious children (a dread alarm sounded by Becky Brown at last week's school board meeting and by candidate Thompson at last night's forum... though interestingly, no one ever discusses the increased fire hazard of packing 2500 people into a gym that could burst into flame at any moment).

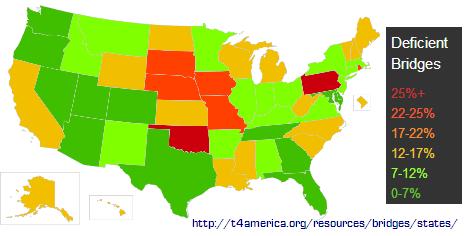

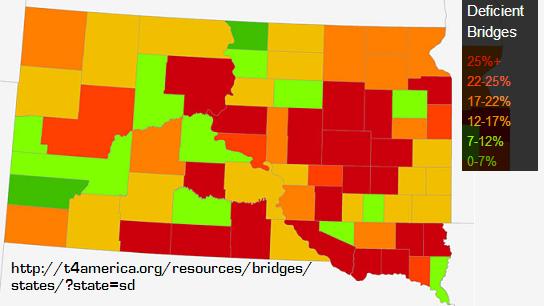

So let's analogize the school renovations to a more dire problem than your kitchen: let's talk bridges. According to a new report by Transportation for America, South Dakota has the fifth worst bridges in the nation.

20.3% of South Dakota's bridges are structurally deficient. If you cross five bridges today, there's a heightened chance that you might not cross one of them when you come to it. A bridge in Beadle County collapsed just last September, not long after a school bus crossed it. I'd say that poses as much peril to kids as a fire in a school.

So South Dakota has 1193 bridges out of 5890 bridges that could use fixing right now. In Lake County, 13 of our 79 bridges are structurally deficient. That's 17%, a bit better than the state average, but still a danger to the average of 2711 vehicles (including school buses) crossing those hazards every day. (Who knew the commute was such a daring adventure?)

Fixing these bridges to ensure public safety is unarguably a priority. As the city commission candidates made clear during last night's forum, infrastructure is a top concern for Madison. And I would bet that we could fix those thirteen dangerous bridges in Lake County more cheaply if we did them all at once, right now. Hire a bridge crew, let them bring all their workers and heavy equipment hear, order all the dirt and steel and concrete they need in one big buy, and do all the work in one fell swoop. That's got to save money, right?

But according to the Madison Daily Leader, in the face of this imminent public peril, with the clear possibility of saving money by doing a massive and immediate upgrade of all of our deficient bridges, our city and county have scheduled seven of those thirteen structurally deficient bridges for replacement over the next six years.

Now I haven't asked our city or county officials why they are waiting to fix these bridges. But I'll bet this piecemeal approach boils down to fiscal reality. Our city and county can maybe only afford to fix one or two bridges at a time.

Our local bridge situation is highly instructive. Solid bridges are not a luxury. Over a hundred times an hour in our county, somebody driving to school or work or the park is risking a sudden dip in the creek. We could save money and possibly lives by fixing all thirteen bridges at once.

But our city and county leaders are apparently making hard choices and saying, "You know what? If we burn up all of our tax dollars right now on fixing all thirteen bridges, we won't have money left for snow removal, or the jail, or other vital public functions."

Jennie Thompson and other gym supporters want it all for our kids. Even fellow school board candidate Shawn Miller, who casts a more austere eye on school budgeting than I do, said last night he wants it all. But as Miller said, it all comes with a price tag. Whether we're talking school renovations, a new luxury gym, or solid bridges, sometimes we just can't afford to do everything at once. We have to accept our fiscal limitations and do the hard work of setting priorities.

bridges are inspected every two years. I believe for the bridges to even be considered for replacement, they have to meet a certain level of deficiency for funding to kick in. So the bridges slated for replacement are the ones in need of replacement. The others could only be starting to show signs of deficiencies and may simply require repairs.

The same taxes that pay for bond issues, capital outlay, school general fund are also used to pay city, township, and county taxes. It allcomes out of the same well-property taxes. If we pay for. more school remodeling, we have less for roads or general fund to pay teachers. Same can be said if we pay more on roads, we have less for a bond issue. In Madison area school district, assuming 7000 residents, every million dollars of bond issuance comes to $142 per person or $571 for a household of 4. Bottom line there is financial impact and there are hard choices to make.

Then consider the actual cost over time of a $17 million bond issue is really $30 million with all the interest included. The interest also has to be paid and also necessarily needs to be included in the cost estimates.

Using Charlie's figures for a family of four, a $17 million bond issue would then be $9,707 extra per year (17 x $571). If instead this family is only paying an extra $100 or $200 or even $300 more per year, who is picking up that extra $9,000 plus? Are these figures correct? And if so, THIS is the problem.

I agree that we need to live within our current budget limitations. But I also agree with Jennie and others that doing this in pieces will cause issues for educating our students. Sending them into a school that is constantly noisy, dirty, with sections closed off because of remodeling year after year is not really a good option either. The best option is to do it all at once, the right way, the first time.

I also agree with Cory that we need to save our teachers. Our first priority should be to address the shortage in the general fund and staffing levels. But, I do think we can revisit the remodel plan within the next 6 months and we should make it a priority. I would go further and say we need to add more teachers, reduce class size, and add back programs and classes that we have lost in the last 10 years. But the reality is Pierre isn't going to help us with this at all. We will have to raise the money through the system we have in place, which is property taxes.

I indeed want it all. I want the best for my kids. I am willing to pay for it, no matter what kind of tax we have to implement to get it done. Maybe we can bring a plan to the city to find some kind of local funding through sales tax, but as we heard last night, the city is broke too. Everyone's broke I guess. Maybe we should just shut down the government. That seems to be a popular theme these days.

Cory... please stop calling it the Gym plan. The Gym plan was 3 years ago and only addressed the needs of the athletic community. The new school plan addressed the needs of every academic area, every extra-curricular activity, fine arts, athletics, public needs, etc. etc. It was a complete MHS remodel plan that included a nice gym.

Sorry, Ashley: building a new gym and renovating an existing facility are two very different projects. Not mentioning the gym is part of the school's manipulative marketing plan. I can't be part of such manipulation. I will continue calling the failed plan what it is: a combination of high school repairs that we need and a big new gym that we don't.

Also, we can do progressive upgrades without disrupting the school environment. See my plan from last October. There's more than one way to skin this cat.

Cory, I agree. I will take 5 or 10 more teachers any day over having a state of the art gym. But I am an optimist and I believe we can convince enough people that we can get it all. If it fails, then I say forget the gym and focus on academics. But we need to try harder and get more of the electorate to the polls to get a better answer. As Mr. Hoffman said last week, the last vote on the MHS remodel issue was hardly a mandate.

Breaking News (Not Really):

Not only are we last in the nation for teacher pay and education funding, almost last for median salaries for workers, we are also last in the nation for tax revenues (or first for the lowest tax collection, depending how you look at it). We collect the lowest amount of taxes in the nation according to this story from Keloland.

http://keloland.com/NewsDetail6162.cfm?Id=113298

We absolutely need to get the electorate on board for raising taxes and supporting government services, like education. South Dakota is one of the states that actually receives more federal funding than we pay in federal taxes, but... we still complain about federal taxes.... even though we get all that money back and more. Yes, budget earmarks do help South Dakota, mostly through large farm bills and farm subsidies.

Now, our education funding is made up of federal funding, state funding, and local funding. Most of our problems are because of state and local taxes. The state refuses to allow an income tax, we have sales tax limits, and we are forced to fund education through property taxes.

We absolutely cannot move forward without raising property taxes. We cannot continue to cut more programs, teachers, and activities. We cannot let our infrastructure fall apart. The only solution is to find more money.

Now there seems to be some very WILD figures about taxes above. These types of scare tactics could be eliminated if someone could build a very simple web page with a calculator for every voter to determine how much his or her taxes would go up. I am sure there is a smart marketing person out there that could put something together for the next campaign that would help us all calculate the exact amount our taxes would go up. I am willing to bet 60% of us could live with those small increases. I would also bet many of the large land owners and lake property owners will object because they have land that is worth/valued at significantly higher levels.

We do need to look at the tax system as Charlie Johnson has said many times. I agree with many of his ideas about raising revenue for our schools through alternative methods. Unfortunately, that is a state issue and he will have to take it up with Russ and Dennis. Locally, we can only do one thing to fund the schools, raise property taxes.

But really.... we already live in a state with the LOWEST taxes in the nation. Couldn't we sacrifice a little more? Maybe we could have the 2nd lowest taxes, or 5th lowest taxes? Without tax revenues... there will be no government services.

-AKA

Just to be clear and to back up my claims above:

For every $1.00 US that South Dakota sends to the government in federal taxes, South Dakota gets $1.51 cents back in funding. That is an amazing return rate, better than any bank would give you. Can you understand how I think taxes are an investment and not a penalty? Without this money, we would lose many of the services we use everyday. In fact, much of that money is coming back to us from those socialist blue states on the coast. Don't believe me, check it out for yourself.

http://visualizingeconomics.com/2010/02/17/federal-taxes-paidreceived-for-each-state/

So all of you wanting to say NO to new taxes, remember how great of a deal you are getting on the federal level.

Let's find a way to fix the state and local taxes so we can improve our education system.

-AKA

{CAH: Ashley, now you're talking like Governor Daugaard, preaching self-reliance. I actually admire that.}

Linda,

The $571 figure is the principal amount if we paid for the project upfront-in other words if everyone had to go home and shake the change out the cookie jar!! That is for the first million-take that times 17 like you did and you start to see real high figures-more than a soda pop/day. Of course the bond issue is not divided up by households but to see my point if you as a household don't pay that amount in additional taxes, then someone else is plus your share.

Linda-

The problem is the math being used, or your interpretation of the math.

The numbers being tossed around were $17 million for the failed gym/building renovation project.

The total amount, with interest, that would have been paid after 30(?) years of payments was $30 million.

The estimated number of residents in the school district is 7000.

30 years to pay $30 million is $1 million per year.

$1 million per year for 7000 school district residents is $142.85 per year for each resident. This number agrees with what Charlie stated.

Keep in mind these are averages, based on numbers being tossed around.

Using your math of a family of 4 paying $9707 per year for 30 years is a total of $291,000 per family of 4 .

If there are an average of 1750 families of 4 in the school district (7000/4 = 1750), and you multiply $291,000 by 1750, you come up with a grand total of $509,250,000.

So, Bud said $2.9 million for the gym only, but if pressed would have said $6.9 million for the rest of the gym pie. The total project price was $16.9 million, before interest.

Charlie supplied some real numbers for a total cost of $30 million with interest, but you managed to turn it into $590,000,000.

I'll stick with Bud's numbers, thanks.

My point exactly, Charlie. This is the 60% or so that Ashley is referring to above that he thinks would be willing to pay a little more in taxes for all the school renovations, gym, frills, etc that he wants right now. And those that pay a little more probably would be willing to pay the extra little bit. He has no problem with making landowners and business owners pay to make up the difference! And he wonders why anyone would object??!! Being self-employed as a farmer or a business owners does NOT mean we are plush with extra money to fund the wants of Ashley or anyone else. It also does not mean that the farmers are big farmers. There are a few of them in the county and most people know who they are. The rest of the landowners are family famers who own land (with the bank etc) as part of their cost of doing business. With attitudes like Ashley's, the community will be further divided into us against them, which accomplishes nothing and harms the community and students.

This is the problem with the entire country right now. People have been conditioned to think there is a bottomless well of money that the gov't deserves in order to fund all wishes and wants. And finally people are being forced to accept the fact that there is not a never-ending stream of money, that gov't agencies have to live within a budget, and that every level of gov't has to realize that they are NOT entitled to higher and higher taxes from the citizenry.

Tax heavy trucks rather than increasing fees on light cars and pickups that do perhaps 1/15,000 as much road damage per mile as do the heavy trucks. Something like a $100 a day fee might cover a small fraction of the actual damage done by heavy trucks to highways and bridges.

Jim, that's why I asked what was wrong with my figures. I knew they didn't add up. Blame it on being too early in the morning before my brain woke up!

So an average family of 4 would pay $17,048 over a period of 30 years with the above figures. However, if a family only pays an extra $200 per year for 30 years, they would only pay $6,000 over 30 years; if the family only paid an extra $100 per year over 30 years, they would pay $3,000 total. Those who pay no property taxes would pay nothing. So who is picking up the balance of the tab for those who are so willing to pay "a little extra?" And how is that fair? And how can anyone wonder why people aren't willing to pick up this much of the tab?

The problem with trying to figure out who will pay more if others pay less is that the dollar amounts being tossed around are all based on the number of people in the school district, and that is not how the burden will be split.

The burden will be figured based on property value. You are right on in wondering about the folks that do not pay property taxes, but the thing is is that SOMEONE is paying taxes on the property where those folks are living.

So, it is possible for a family of 6 to send 4 kids to school, not own any property, and not see an increase in their taxes. What they might see is an increase in the lease/rent payments handed down to them by the property owner.

You could also have an elderly couple, with no kids or grandkids in the school system, that owns some, or many, acres of land, and maybe a rental house or 2 in the district, that would see a major increase in their tax burden.

Fair? No.

Perhaps an additional penny tax on any and all purchases made at any and all businesses in the school district would be enough to cover the $1 million payment per year. Maybe we could monitor the spending of all 7000 residents and charge them the extra penny tax no matter where in the county, state, nation, or world they spend their money.

Fair? No.

There is not a single solution that will keep everyone happy, or that will be fair across the board. That is something we can all agree on.

Jim, I will roll with you insofar as the school board can't do anything about who pays. No matter what we do, the same people will be hit disproportionately. Farmers get hammered, Sioux Falls folks with fancy lake homes get hit without a say... we can't fix that in a school board meeting.

The only thing we can do is work to overcome complaints about an unfair tax burden and lack of concern for taxpayers and voter input by reopening the process, building a new plan, probably a scaled-down plan that accounts very clearly for how each dollar is being spent and works its way, step-by-step, toward the threshold where people say, "That's all we can afford to do right now"... or more importantly, "These are the things we can't afford not to do."

That freeze-thaw thing wracks my bridgedeckophobia every year. Ice around pylons and pilings makes me want to cross at the Oahe Dam; even Big Bend gives me the willyboogers.