While Rep. Noem peddles the fantasy that approving a pipeline will drastically reduce gasoline prices, and as South Dakota Republicans clutter gas pumps with propaganda falsely blaming the President for spinning numbers at the pump, Senator Jeff Bingaman of New Mexico offers the last thing GOP shoutmeisters want you to hear: truth about energy policy.

First, read the comment section over at Dakota War College, where Troy Jones joins a host of nameless GOP sock puppets to argue that President Obama has stood in the way of increasing domestic energy production. The Republican party needs you to believe that that man in the White House is starving you of energy.

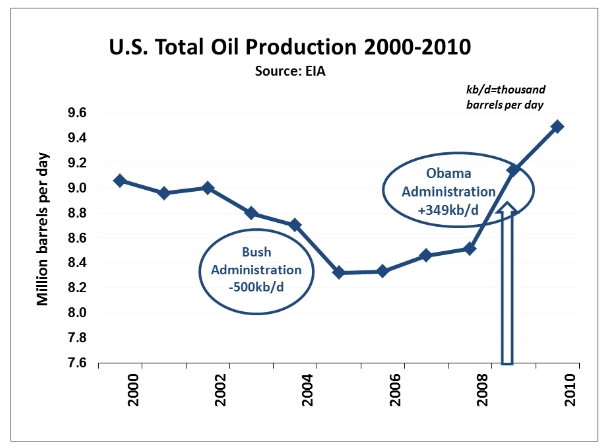

Then turn to Senator Bingaman, who uses data from the Energy Information Administration to chart U.S. oil production since 2000:

U.S. oil production decreased from over 9.0 million barrels per day in 2000 to under 8.4 Mbpd in 2005 and 2006, then crept up to 8.5 Mbpd by 2008. In 2009, U.S. oil production jumped to almost 9.2 Mbpd. In 2010, it increased again to 9.5 Mbpd.

In short, during President Obama's first year in charge, U.S. oil producers completely reversed the production decline of the eight G. W. Bush years.

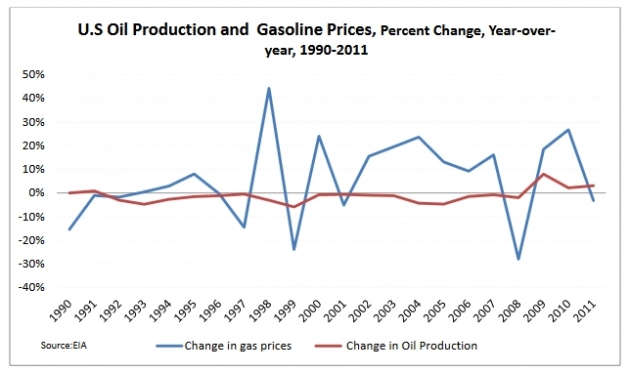

Bingaman also punctures the GOP appeal to economic abstraction ("increased supply decreases prices!") and shows that theory doesn't always translate into practice:

Over the last two decades, changes in U.S. oil production just don't track with changes in gasoline prices. So even if President Obama were hindering oil production, they'd still bump into this non-correlation. Gasoline prices are set on the world market; increasing or decreasing U.S. production doesn't make a dent.

Senator Bingaman's charts make clear that "Drill, Baby, Drill!" is a slogan, not a solution. He's not against oil production: he says we should celebrate our ability to use technology to "punch above our weight." But he says that we must complement increased production with decreased consumption:

So how do we continue on this path toward reduced oil use and dependence? I think there are three areas we can focus on. First, we need to enable further expansion of our renewable fuel industry, which is currently facing infrastructure and financing constraints. Second, we need to move forward the timeline for market penetration of electric vehicles. Finally, we need to make sure that we use natural gas vehicles in as many applications as make sense, based on that technology.

...The long-term solution to the challenge of high and volatile oil prices is to continue to reduce our dependence on oil, period. This is a strategic vision that President George W. Bush, who previously had worked in the oil industry, clearly articulated in his State of the Union speech in 2006. We subsequently proved in Congress in 2007, the year after that State of the Union speech, that we have the ability to make significant changes in our energy consumption, and that it is possible to mobilize a bipartisan consensus to do that [Senator Jeff Bingaman (D-NM), "Oil Prices, Gas Prices, and Domestic Production," U.S. Senate floor speech, 2012.03.07].

By the way, my family owns two cars. Neither one moved yesterday. I biked to school. My daughter walked to school. My wife walked to the grocery store and to church. Our quality of life has never been better.

New Mexico is a major oil producer.

Earth hater Governor Martinez is an oil company hack who is currently attempting to ban movie productions in the state as film makers are exposed the rotting underbelly of the fossil fuel history in the state.

exposing, rather:

http://www.sacbee.com/2012/03/15/4339430/cross-border-announces-production.html

Oil is priced in US dollars, Brazil Russia China and others are losing confidence in the US dollar and are starting to trade Oil in currencies other then dollars. This has lowered the value of our dollar and we are now exporting more Oil. Gasoline is still about 15 cents per gallon when priced in pre-1964 US coins. Gasoline has not gone up in price the value of dollars have gone down. You can thank chairmen Ben Bernanke of the Federal Reserve for that.

...none of which, Aaron, changes the soundness of Bingaman's analysis that our best route to energy security is to use less oil.

Well if our oil wasn't considered cheap by the rest of the world due to our weak currency, then we would have more oil here for domestic use.

So Aaron, is the solution to produce more oil in the US for purpose of export because it's so cheap for foreigners to buy? What do you say about the argument that oil companies want to maximize their profits so if they can make more money keeping oil in the US (as opposed to shipping it elsewhere) they would do so?

Aaron, please stop trying to shoehorn every problem into your oversimplified Ron-Paul economics. Your comments above are a worldview in search of rationalization. What really matters here is that we work harder to use less oil and get more work out of the energy resources we have.

The word from the oil patch:

http://wyofile.com/2012/03/fact-checking-barrasso-on-gas-prices/

I have some firsthand experience as to some of the problems of the oil industry. I, of course, am in the oil bidness due to a small amount of inherited mineral rights in North Dakota. I've been getting royalty checks form Hess for years, but last year there was something new. My brother and I have had to deal with XTO, which I think was bought by Exxon a while back, but, in the mess my bro and I are ensnared in, may be stalking for some other outfit.

The oil bidness is much like the snake oil bidness, we've discovered. A few months ago we were asked to participate in a fracking well going after oil in the Bakken formation. We would have had to pony up money to invest in this operation that was estimated to cost multi-millions for one well. We opted not to participate, partly because we couldn't trust what we were being told and partly because we're not in favor of fracking. What this means, of course, is not that the oil company would respect our property rights, and not take the oil in our mineral property. What it meant was we would be force pooled, essentially meaning that our oil would be stolen from us against our will and we would take whatever the oil company decided it wanted to give us.

That's what's happening all over this country, as drilling on private lands has exploded. And all over the country, the big oil giants are screwing the small property owners.

Anyway, the latest thing sort of show how the oil companies operate. When XTO want our money, they had no problem accepting the fact that my brother inherited these mineral rights. We submitted the info, and we both received a big packet of information, and a request to pony up some money. But now just months later, they seemed to have lost all that information we sent them, and won't believe that we are, in fact, the rightful owners of the mineral property.

Oil rustlers, robosigners, or incompetent? We can't figure it out. One thing is they don't sign any of their correspondence so you never can respond to them. When you call to ask about or provide them information you never get the right answer or anyone who can follow up.

My guess is they are stealing private mineral owners blind, just like they stole from the tribes and the federal government.

The world is full of complex problems that have simple (but hard) solutions.

Here you go folks.

http://www.youtube.com/watch?v=eQYy25kLijA

You and Sibby should get a room, Aaron: hang an effigy of the President, strangle a couple of cats, look at some porn, then pray for forgiveness for squandering your gifts from your creator as the James River sends poison to the Gulf of Mexico...again.