If college kids could just disguise themselves as corn...

Rick Santorum is gone, but his education legacy lives on. Rep. Kristi Noem wants to make sure fewer Americans become college snobs. In her support for the Paul Ryan budget, our Congresswoman voted to slash Pell Grants, just as she did last year. Her anti-student, anti-education vote this year would eliminate grants for 400,000 students nationwide and reduce assistance to 9,000,000 more students.

A U.S. Department of Education estimate says that Noem is voting to deny Pell Grants to 1,223 South Dakota students. (That's 1,223 students who had better be registering and voting against Noem this November.) The net loss in assistance to South Dakotans is $8.8 million a year. (That's another several thousand parents, professors, and university administrators who had better vote their pocketbook in November.)

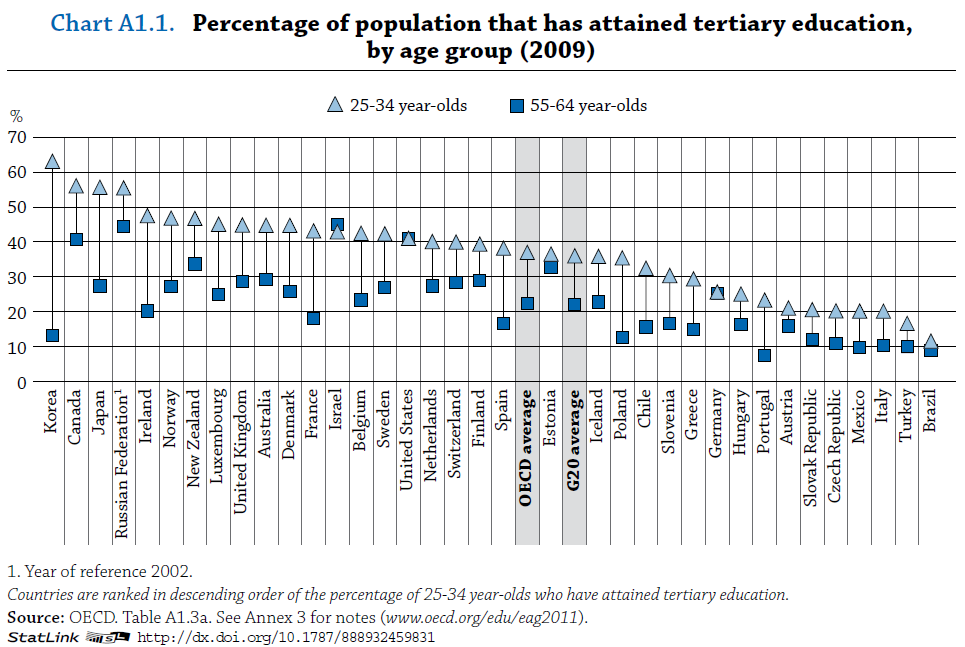

Noem's anti-education vote fits with this dismaying chart posted by Jared Bernstein:

Almost all of our competitors in the global economy are putting more of their people through college than they did a generation ago. On that metric, we, Israel, Germany, and Brazil are pretty much staying put. With her cuts to Pell Grants, Rep. Noem must be gambling on some vague educational and economic American exceptionalism.

Remember: Kristi Noem doesn't want kids getting financial assistance for college... but she wants the federal government to keep giving her family handouts for corn and crop insurance. She'd rather have more cheap corn and profits for her family than more college graduates.

Let's see how many of her fellow students cheer when Kristi walks across the stage for her SDSU diploma next month.

Corey, I May not agree with you about the Crop Insurance, we would never be able to afford food and my family wouldn't be able to make a living if we had to pay almost 200,000 dollars in insurance. Although I am happy to see direct payments go. There are other ways to cut the budget. Crop insurance is less than 1% of the budget. As a college student I completley agree that we need to educate our workforce or unemployment isn't going to get any better.

Jenae,

What responsibility does the taxpayer have to provide your family $200,000 in subsidies? I'm one farmer asking another.

Here is the challenge:

1) We borrow 40% of what the federal government spends. This is unsustainable.

2) We can't raise taxes on the rich enough to make up the difference.

We have two choices:

1) Raise taxes on the middle class or

2) Cut spending significantly by eliminating entire programs.

From my perspective, when we have adequate loan options to help people get college degrees where they will earn income to pay back the loans, reduction of grants isn't draconian. Becoming Greece will be draconian.

Troy:

There is a third choice that you seem to be choosing to ignore. We have reached the point where we must cut spending AND raise taxes. It is the only way our nation will ever have a reasonable chance at balancing its budget and making a tiny dent in the deficit.

Substitute the word OR in your post with AND, and you can cross out "eliminating entire programs." Such drama.

Trying to remember what a false choice argument is...two choices is all we have?

There's an old saying "How do you eat an elephant?...one bite at a time" (And yes the imagery of the elephant is deliberate.)

But looking at Troy's options...put the burden on the middle class and leave the rich alone seems to be grossly intellectually dishonest. Maybe some of you that excelled at debate can jump in here.

So how much is selling out the future of potential college grads going to cost? I think it's around $3 Billion. How much would be added if the Buffet Rule were placed in effect? I think Troy had it at $5 billion a year.

So Troy is that the choice you are making? Let Paris Hilton skate at a lower rate than working class parents are paying and letting higher ed become a thing of the past for way too many families.

God bless you for thinking of saving Paris and making sure that middle class families learn the dignity of hard work.

Raising taxes is already in the pipeline, as is cutting expenses, isn't it Troy? The Bush tax cuts expiration and sequestration requiring military and entitlement cuts are already on the lawbooks.

Doesn't that more than handle the deficit?

Isn't the real problem that the GOP doesn't want these things to happen and would like alternative legislation?

And don't you think they'll have to learn to play nicer in the sandbox if they're going to get it?

Dave: I meant to put "and/or." I really did. Good catch.

Jana: I didn't mean to imply leaving the rich alone. But I see why what I wrote would indicated that. Fair interpretation. All I am saying is the deficit gap can only be closed by increasing taxes on the middle class (this is where the money is). Not doing so will result in gutting entire programs when we spend 40% more than we take in. Cutting along the margin will not add up.

As much as the Buffet rule sounds appealing from a "fairness" perspective, it only happens with an increase (direct or indirect through an Alternative Minimum Tax computation) on capital gains. This has two very palpable negative impacts as history bears out.

1) Capital gains revenues go up at lower rates because transactions that unlock the value and are available to be taxed. No transaction, not capital gains revenue.

2) Transactions are good for job and economic growth. Synergies are found and new ownership usually leads to new innovations. And, the transaction almost always provides the acquired companies with growth capital not otherwise available.

Raise the capital gains rates, you will get less transactions. Raise it as you propose by the Buffet Rule, my guess is you will generate less net revenue to the treasury and not $5Billion more.

To get more income (assuming it won't have an adverse effect on employment and economic activity which is a big assumption) can only come from a broadbased income tax increase.

I don't know if this is true but recall reading the following:

If we did the following, we could eliminate the deficit:

1) 5% surcharge tax on Adjusted Gross Income of under $50,000.

2) 10% surcharge tax AGI between $50K and $250K.

If we did the following, we would maybe cover 15% of the deficit: 20% increase on AGI above $250K.

And, here is the rub: Both computations assume the tax increase on those making under $250K wouldn't affect consumption and those over 20% wouldn't affect business hiring or business activity. Impossible don't you think.

The only solution is economic growth that leads to business investment and hiring. The debate is all-skewed on all sides. Democrats don't entertain any program cuts that add up to anything, no tax increases on the 47% of Americans who paid no income taxes in 2009, and no lessening of any business regulations. Republicans will not entertain taxes going up on anyone (they are defending no increases on rich as that is the only proposal and don't have the courage to increase taxes on the middle and lower classes).

Together they should set broad budget cut parameters and then argue about where they occur. Here is where I'd start:

Five year plan that automatically cuts EVERY program to 2008 levels 20% a year. Then, if one side (liberal or conservative) wants to stop an automatic cut from occurring they have to propose an alternative cut somewhere else or an across-the board AGI surcharge along the lines of the formula I proposed above (5%, 10%, 20%) and get it passed or have it fail. No filibustering of the budget amendments just "Do you support stopping this automatic cut in one program AND cutting this program and/ or raising taxes across the board."

This will do two things I think are critical:

1) Get liberals to engage on the growth issue. "Fairness" and protecting every liberal special interest will become less important as they see conservatives sacred cows also getting cut.

2) Get conservatives to acknowledge taxes are part of the solution whether they like it or not and that everyone will be sharing in the tax increase (vs. targeting just the rich) plus while their sacred cows will experience real cuts they will see liberals sharing in the cuts. P.S. Economic conservatives like me don't have a love or concern for the rich. We just know they are the goose which lays the golden egg (either because the top 10% already pay 70% of the income taxes or as our employer).

Awesome post Troy. The only problem I see is depending on always increasing the consumption rate of natural resources. We need to be satisfied with less "stuff". That doesn't fit into a budget solution that depends on growth to get us out of the hole we are in.

Troy, what it is the economic impact on the larger economy of taking more out disposable/savings/investment dollars out of the middle class?

I understand your perspective of protecting the wealthy from any sense of them paying the same rate, but doesn't your plan have both intended and unintended consequences?

Just for fun, what do you see those consequences being?

MB, no growth. No solution but to gut programs. Either by exercising our soveriegn independence by votes by Congress or forced down our throats ala Greece from our lenders. I prefer the former.

Troy, as our resident cutter, what do you see as the impact of cutting Pell Grants, raising fees and tuitions at the same time as taking more money out of the middle class family budget?

I'm guessing you've thought this one through as you seem to think that having students amass great debt is a good idea.

Jana, consumption would be affected by a tax increase. That is why I think a liberal/conservative consensus would quickly come around to an orderly AND timely reduction of expenditures to 2008 levels. And the argument between us (in the body politic) would be what ones get cut more. I look forward to that argument and I hope so would you.

Here is all I know: We have more per capita debt than Greece and in just a few years it will exceed their percentage of GDP. A reckoning is coming. Question: Do you want it to be done by our elected representatives or by our lenders?

P.S. I'm not protecting the rich. They will pay the brunt of every tax increase (especially in percentage).

I'd think you would give a fellow SDSU alum (albeit a future one) some slack...

Elliot,

Surely you jest! I say rub it in! MOO-U BOO! USD YAY!

Janae, I'll let Charlie handle the crop insurance side. Let me look at subsidies. Suppose you have a family of five kids. You want to send all five to college. Your income is low, and all five qualify for Pell grants. If each kid goes to college for four years and gets the maximum Pell Grant each year, the feds invest $112,720 in your family's college education over a span of, oh, say, 15 years.

Now compare that the the money the feds invested in Kristi's family over oh, say, 15 years. The feds poured $3.13 million in farm subsidies into keeping the Noem family business afloat. That same amount of money could have provided full Pell grants for four years to nearly 140 students.

Maybe we can afford to give the Noems $3.13 million and send 140 more kids to college, or at least reduce their debt so they can more quickly pay off their loans, start businesses, buy homes, etc. Maybe we can't afford to do either. But if we have to pick, which do you think is the better investment of tax dollars?

Mike, Rep. Noem's graduation reduces the value of my SDSU diploma.

Cory,

It certainly does. :P

So Troy, you think that the rich will pay the brunt? "They will pay the brunt of every tax increase (especially in percentage)."

Maybe you can give us some historical data that proves how the rich have born the brunt of the Republican great recession. Your a man that loves the facts...so show us how the rich have born the brunt over the last decade of the war on the middle class.

Sorry Troy, I guess I was a little insensitive to the wealthy that have to muddle through their incredibly tax rates that are sitting at the lowest they've ever been...:-)

Just thinking that they could actually pay the same percentage is probably too much to ask for people who have to navigate off shore investments and car elevators.

forgive me...carry on with your thought that the rich have suffered enough and shouldn't have to sacrifice in balancing the budget. How silly of me.

Jana,

Was there a thought in that comment?

Oh Troy, you are such a clever little one. To which comment were you referring?

Here's an old one for you to comment on. What do you think of letting the Bush tax cuts expire? You certainly remember them. they were the ones that the Republicans sold in as "temporary?"

I think we should perhaps have a rule about bringing up Greece and trying to compare it economically to the US. (Especially when smart people like Troy do it.)

Can we agree that comparing the Greek situation to ours is like comparing my financial statement to Bill Gates's? Only with one other key distinction... Just in case... in a pinch... Bill Gates (in my hypothetical) has a printing press in his basement and can print money legally.

Maybe we just throw down some baklava or something?

Some gyros maybe.

Bill,

Just remember even Nelson Bunker Hunt, on of the richest men in the world, filed bankruptcy. Your inference is a little Pollyannish. What if you are wrong answer become Greece?

Pew brings news that men are returning to the workforce at four times women's rates: service sector most active.

Jana,

As you remember, the Bush tax cuts were a tax cut for everyone and are a substantial reason 47% of Americans pay no federal income taxes.

But to your question: I believe we are spending too much. Any tax increase (expiration included) needs to include a significant spending reduction, ala my idea for an orderly reduction as I outlined above. If someone wants to propose reducing or eliminating a cut in such a plan by a partial or wholesale elimination of the BTC's, I think it should be debated. If it passes, I'm willing to live with it. Might not like it but I can't have everything.

Question Jana, Ryan has a plan, I laid out one. Both of which eliminate the deficit. Where is yours? Or are you like Obama who criticizes others without one of your own.

Final comment: Bill mentions printing money. We have printed trillions of dollars the last three years. Just look at the change in the Federal Reserves balance sheet. Last year they printed $500Billion and bought nearly 75% of the deficit. There is a very severe consequence to this that will damper future recovery as well. Unless we want to have rampant inflation (which hurts the poor the most), they will have to sell that debt and "retire" that money from the money supply. Failure to do that will cause federal borrowing costs for all this debt to skyrocket. A 1% increase in interest rates will cost the government about $150million. If inflation grew to 5%, it is estimated borrowing costs could grow to a trillion dollars.

We have been playing a shell game:

1) Printing money to buy our deficit. As the velocity of money picks up if there is a recovery, this money must be retired or borrowing costs go up adding to the financial problem (keep in mind higher interest rates will affect every business and individual in America. It will drop value of houses, reduce hiring, etc.)

2) Borrowing 40% of every dollar the federal government spends ballooning the debt in four years under Obama to nearly double what Bush did in 8.

Paul Ryan is likely insane. Deficits keep US exports more appealing.

"President Obama for example has proposed raising the qualification age for Medicare to 67." Frum.

I want to add a couple of points to this discussion that come from this article http://www.theatlantic.com/business/archive/2012/04/how-we-pay-taxes-11-charts/255954/

As one scrolls through the charts, a couple of points strike me as important. First, federal revenue from corporations has fallen rather dramatically (first chart--I know it's not to scale, but I think it makes the point)

Second, the problem will continue to be a Gordian Knot as long as defense, social security, Medicaire/Medicaid, and safety net each compose an equal share of spending.

I'm not sure it Troy included defense when he said "every program" but until we look at cutting there, the problem won't be solved. Given that the US defense spending equals the spending of the next 10 countries combined, defense has to be on the block as well as safety net programs.

Umm...Troy... Obama has laid out a budget...surprised you missed that.

http://www.whitehouse.gov/omb/budget

Troy, forgetting Greece for a moment...what if we become Germany?

http://www.huffingtonpost.com/robert-reich/why-a-fair-economy-is-not_b_1429151.html

While the great oppressed worshiping at the church of Norquist continue to wail, it's not as bad as they would like us to believe.

http://www.americanprogress.org/issues/2011/06/low_tax.html