If you were born after the Eisenhower administration, you've never seen lower federal taxes in America than you do right now under the Obama administration. I've mentioned this fact before, but Rep. Kristi Noem and Senator John Thune keep repeating their residual Norquistism that our budget deficit comes entirely from too much spending and not from too little revenue, I have to keep pointing out the facts.

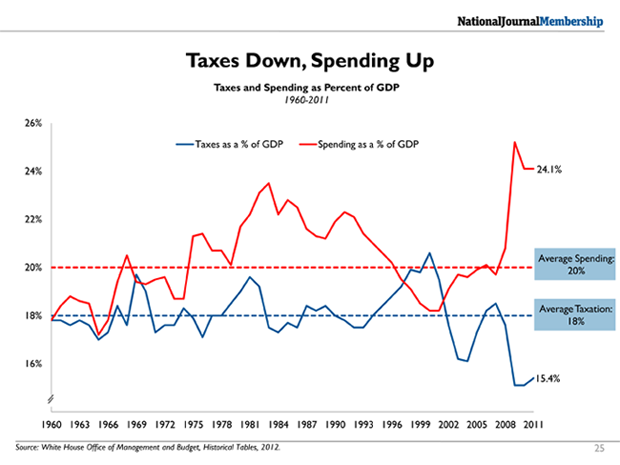

This time Charlie Cook from the National Journal helps me out with this simple chart of our federal taxing and spending over the last five decades:

The dotted lines show that, yes, we do have an ongoing problem of spending (red) more than we collect in taxes (blue). But notice also the two big dips of the last decade. Faced with recessions, we dropped our tax rates in hopes of stimulating the economy. Even with the increases imposed by the fiscal cliff deal, we are still dedicating a notably smaller chunk of our national income to running the state than we did in, most tellingly, the 1990s, during which time we had a happily humming economy that I bet nine out of ten people would love to return to. The 1990s were also the halcyon days when a Democratic President and a Republican Congress could agree on a budget that paid down our debt.

The above chart makes clear that the one-sided fiscal policy of Thune and Noem is a fairy tale. We will not solve our budget deficit just by cutting spending, especially not when Thune and Noem keep fighting for their pet projects here in South Dakota. We will properly address the debt when we face reality: our historically low tax rates make it impossible to balance the budget. A responsible budget will include spending cuts and tax increases.

President Obama's 2nd term is a window of opportunity to put us on a sound fiscal path. You can't depend on a 1st term President to make tough fiscal decisions while hoping to be re-elected. But a 2nd term President can take the high road.

So, Mr. President. Time to address Republican spending concerns by laying out a plan that both increases revenue but also cuts spending. A major component needs to be returning payment responsibility for non-federal projects to the lower levels of government (or the private sector entities) that want those projects.

When Sioux Falls wants a bridge on 41st street, there's no reason the federal government should pay for that. When SD wants to create Blood Run State Park I'm all for that, but the federal government doesn't need to pay for a state park. When Tom Daschle wanted the Daschle Library at SDSU, well, he can raise the money privately like Presidents do for Presidential libraries. I'm still waiting for him to do that because that would be a worthwhile privately-funded project. You get the point.

Hrm... so if we fixed taxes to be 18% of GDP, and fixed spending to be 17.5% of GDP, that would slowly whittle away at our debt. What would that burden look like for taxpayers vs gov't spending?

If we split the difference and said raise taxes to be 19% of GDP, and Spending to be below that until the debt is elimanted, then match 19%, that would split the baby of averages.

We've gotten so used to regressive taxation and transfer of wealth from the poor to the rich, that even the merest hint of movement back in the direction of reason elicits shrieks of "Socialism!" from the Investor Class, who rule us all, and who would like nothing better than to stick all of us widdo peepo with a huge value-added tax.

When Ike was President the highest tax rate was 90%. Today, it is 35%. Supply side economics, especially since Reagan, is the major cause for our Federal deficits today (plus the Bush Wars) and not the social welfare state.

Republicans over the years (Reagan in '81 and Bush in '01) have always cited the Kennedy cut in the tax rates in 1962 to justify their policies, but what they do not tell you is that Kennedy paid for his tax cuts, while Ronny and "Dubya" just added their costs to the Federal deficit.

The GOP failures accrue: "You’ll notice that in the states of SD, NB, KS, NM, CO, WY, MT, ID, UT, AZ, NV, OR every single House GOP member voted against Hurricane Sandy Aid. Therefore, the Denver Post’s lament, “We have no complaint about Congress stepping up to help those affected by Hurricane Sandy. But the same spirit must extend to less populated areas in the West” is just bizarre given the facts."

http://ncfp.wordpress.com/2013/01/19/fire-vs-flood-or-east-vs-west-emergency-relief/#comment-13105

Yet Noem, et al. beg the feds for resources to control the pine beetle as it clears the effects of fire suppression and anthropogenic climate change.