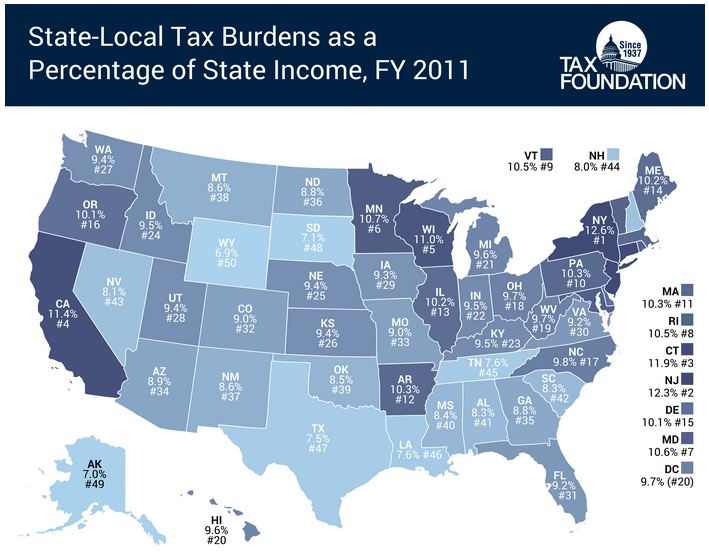

A new report from the Tax Foundation finds that in 2011, South Dakotans enjoyed the third-lowest state and local tax burden as a percentage of per capita income in the nation:

South Dakota's state/local tax burden actually dropped 0.7 percentage points from 2010, as we paid 2.5% less in non-federal taxes while boosting our per capita income by 8.3%.

As we discussed when the Tax Foundation issued its previous report on this topic in 2012, our low total state/local tax burden remains low just as the percentage of state and local taxes that we pay to other states remains high. That amount (what shall we call it: revenue flight? tax leakage?) jumped by 7.7% from 2010 to 2011. 44.3% of the state and local taxes we pay go to other states. New Hampshire's tax leakage is just a tiny tick higher than ours, at 44.5%; Wyoming's is the highest in the nation at 53.2%. Minnesotans export just 24.1% of their state and local taxes; the only state with lower tax leakage is California, at 20.7%.

Think of those numbers this way: Out of each thousand dollars we South Dakotans spend to incur taxes, we're spending $443 outside of South Dakota. Out of each grand our Minnesota cousins spend to catch the eye of the tax man, they spend just $241 outside of their home state.

Minnesota's state and local governments thus enjoy a double advantage (or call it a whammy and an advantage, if taxes make you cross) over South Dakota's: Minnesotans choose to make more of their wealth available for public spending with their higher tax rates. They then compound that revenue by spending more of their income in-state, meaning their state and counties and towns have more revenue to pay teachers and patch potholes.

And here's a kicker: even after you assess Minnesota's whopping 10.7% (sixth-highest!) state and local taxes, average per capita income in Minnesota is still $534 higher than it is in South Dakota.

Governor Daugaard will surely tout that third-lowest tax burden on his next trip to the Mall of America. But it appears he'll be heard by a lot of South Dakotans who take their tax-generating business to Minnesota to help that state get even richer.