Last updated on 2014.09.18

TransCanada has put in motion the official process to renew its expired construction permit for the Keystone XL pipeline. On Monday, the Canadian pipeliner asked the South Dakota Public Utilities Commission to recertify its project.

While TransCanada and its dupes peddle their inflated jobs numbers, let's look at the original arguments the coaxed the PUC to approve the project in 2010. The PUC's Amended Final Decision greenlighting Keystone XL included the following findings of fact on the purpose of and demand for the project:

14. The purpose of the Project is to transport incremental crude oil production from the Western Canadian Sedimentary Basin ("WCSB") to meet growing demand by refineries and markets in the United States ("U.S."). This supply will serve to replace U.S. reliance on less stable and less reliable sources of offshore crude oil.

24. The transport of additional crude oil production from the WCSB is necessary to meet growing demand by refineries and markets in the U.S. The need for the project is dictated by a number of factors, including increasing WCSB crude oil supply combined with insufficient export pipeline capacity; increasing crude oil demand in the U.S. and decreasing domestic crude supply; the opportunity to reduce U.S. dependence on foreign off-shore oil through increased access to stable, secure Canadian crude oil supplies; and binding shipper commitments to utilize the Keystone Pipeline Project.

25. According to the U.S. Energy Information Administration ("EIA"), U.S. demand for petroleum products has increased by over 11 percent or 2,000,000 bpd over the past 10 years and is expected to increase further. The EIA estimates that total U.S. petroleum consumption will increases by approximately 10 million [sic] bpd over the next 10 years, representing average demand growth of about 100,000 [sic] bpd per year (EIA Annual Energy Outlook 2008).

26. At the same time, domestic U.S. crude oil supplies continue to decline. For example, over the past 10 years, domestic crude production in the United States has declined at an average rate of about 135,000 bpd per year, or 2% per year.... Crude and refined petroleum product imports into the U.S. have increased by over 3.3 million bpd over the past 10 years. In 2007, the U.S. imported over 13.4 million bpd of crude oil and petroleum products or over 60 percent of total U.S. petroleum product consumption. Canada is currently the largest supplier of imported crude oil and refined products to the U.S., supplying over 2.4 million bpd in 2007, representing over 11 percent of total U.S. petroleum product consumption (EIA 2007) [South Dakota Public Utilities Commission, Amended Final Decision and Order, TransCanada Keystone XL Pipeline application, 2010.06.29].

First let us note that Finding of Fact #14 is not fact. TransCanada is not seeking to ship more oil to the U.S. Keystone XL will ship more oil through the U.S. to the international market, raising our gasoline prices in the process.

Besides, TransCanada can't count on the U.S. market, because we are using less oil. Let's look at new EIA data and projections showing the significant changes in the oil market in the four years since the PUC issued its findings:

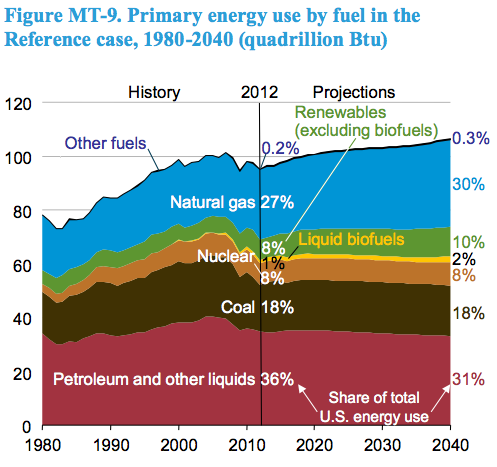

U.S. demand for petroleum is no longer increasing. U.S. demand for petroleum peaked in 2007, which appears to be the final year the PUC considered in formulating its economic analysis. Petroleum demand plunged during the recession. The EIA projects U.S. petroleum use will remain flat over the next 25 years.

EIA projects U.S. crude oil consumption will decrease 0.1% a year through 2040 (see EIA AEO 2014, p. A-1).

U.S. domestic crude production is no longer declining. U.S. production troughed at about the same time U.S. consumption peaked. Booming oil production on the Bakken and elsewhere has erased the preceding twenty-year decline and will likely remain above the previous 1990 peak through 2040.

The EIA projects domestic crude oil and lease condensate energy production will increase 0.5% a year through 2040 (see EIA AEO 2014, p. A-1).

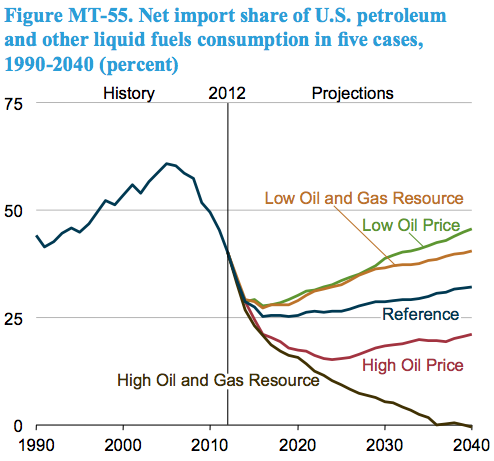

U.S. petroleum imports are no longer increasing. Same arc: increase to the mid-2000s, followed by a dramatic decrease thanks to recession- and conservation-driven reductions in consumption and Bakken-frackin' production increases. In the best-case scenario, the U.S. is a net exporter by the mid-2030s. Worst-case, our imports return to a bit above current levels, still less than 50%.

The EIA projects that U.S. crude oil imports will decrease 0.2% a year through 2040 (see EIA AEO 2014, p. A-1).

TransCanada does not have to make an economic case to the Public Utilities Commission. The pipeliners' burden of proof consists mostly of showing that they'll follow the rules and not kill anybody.

But if Commissioners Hanson, Nelson, and Fiegen are going to include economic and energy security justifications in their discussion of the merits of Keystone XL, they'll want to revisit the oil market and consider the significant changes that have taken place in U.S. oil consumption, production, and imports since the PUC issued TransCanada its initial permit.

The PUC is yet another republican controlled part of state government, there is no way they stand in the way of that pipe.

Is Keystone XL the reward to the Communist Chinese for the failed Rounds Scandal EB-5 program?

Tim, I'm going to be an optimist: I'm going to maintain that, if opponents of the pipeline mobilize and file hefty, well-evidenced arguments against the pipeline, they may get a fair hearing. I agree the chances of outright rejection of the permit recertification are slim, but I think evidence of the changing oil market, along with the work we've done over the last four years to put the lie to TransCanada's claims about job creation and other domestic economic benefits, will make TransCanada's job much harder this time than last.

Very well researched article. The actual need for the KXL could well be TransCanada's Achilles Heel in the PUC's certification hearings for the KXL. During the permit hearings in 2009/2010 the PUC commissioners treated us fairly and with respect, I don't look for things to be any different this time. Another thing that has changed since 2010 is people's perception of climate change, this could also play a role.

Cory, I hope you're right, every time I give republicans the benefit of the doubt they prove me wrong.