Last updated on 2013.09.30

Madison and Lake County are on their way to establishing a second tax increment financing (TIF) district. At their September 5 meeting, the Madison City Commission approved Resolution 2013-26, consenting to Lake County's creation of Tax Increment District Number Two "within the corporate limits of the City."

Funny thing was, neither that resolution nor that night's agenda packet nor any other online document I could find told us where that TIF district would be, or who was asking for it, or what they were going to do with it. Also funny was that the Lake County Commission hadn't taken any formal action on any proposal to create a TIF district.

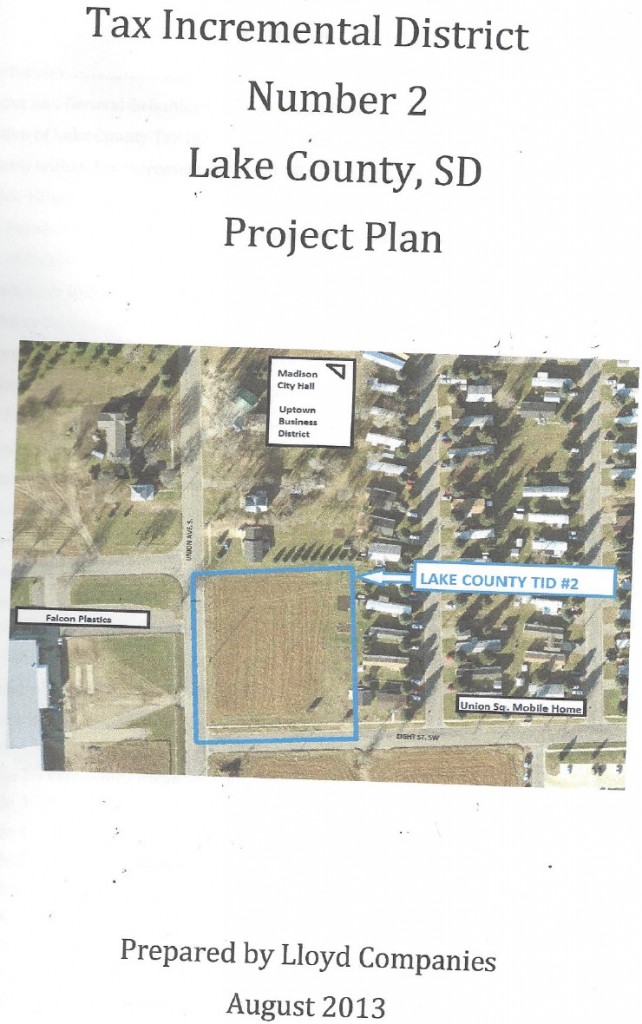

A little digging revealed that the proposal for TIF district #2 comes from Lloyd Companies in Sioux Falls. Lloyd prefers that their proposal not circulate until they finalize it. But the draft I have says that Lloyd (or, per the plan, a developer LLC that will be formed once Lake County O.K.'s the TIF) wants to build two 14-unit multi-family townhome-style apartment buildings on 1.7 empty acres at the corner of South Union Avenue and Eighth Street Southwest, between Falcon Plastics and the Union Square trailer park. They're ready to start this fall, if you and I and the rest of Lake County's taxpayers will just cover $419,450 of their projected two million-plus in start-up/construction costs.

Oooo. Let's see: if you're building a house, how would like the county to take 20% of the cost off your shoulders?

Yeah. I thought so.

Don't hold your breath. You, fellow home-builder, won't get that deal. State law says that tax increment financing may not be used "for the construction of residential structures." TIFs are to take out blight and promote economic development "through the promotion and advancement of industrial, commercial, manufacturing, agricultural, or natural resources." State law does include some housing projects in its definition of legitimate economic development projects that tax dollars may fund, but only housing for the elderly and the handicapped.

Lloyd reads state law, too. They won't use our money to build the apartments themselves. They'll use our money to clear and grade the lot, put in sewer and sidewalks and pavement, pay their architect, and other items authorized by tax increment finance law. To fit housing into the TIF scheme, Lloyd says expanding Madison's tight housing market is the linchpin to getting local bunnies to fart economic development rainbows:

At the present time, the number one concern in Madison, South Dakota is the lack of residential rental property. A Lake Area Improvement Corporation (LAIC) housing study was completed (2007) which demonstrated that there was need for housing development in many categories. To-date significant rental housing has not taken place to alleviate the need. In 2013 the Madison Chamber of Commerce and the Lake Area Improvement Corporation Housing Committee again determined that Madison was critically short of apartments for workforce housing.

As a result of this shortage, business which would like to expand their work force are having to put such plans on hold because there are not available living quarters for new employees. Dakota State University indicates that potential students have difficulty finding available rental property within the City of Madison, which could affect enrollment. Dakota State University also has concerns related to housing for graduates and incoming university personnel to reside within.

The development of this project will help alleviate the housing shortage, helping local businesses to expand, which will provide additional jobs and business opportunities in the commercial district of the City of Madison and Lake County [Lloyd Companies, "Tax Incremental District Number 2, Lake County, SD Project Plan," draft, August 2013].

We build apartments, workers and students can move here, and then businesses can expand—that sequence shows this TIF proposal is at least one step and maybe two removed from the direct economic development activities authorized by SDCL Chapter 9-54.

But if the legality of another residential TIF district in Madison smells a little fishy, the economics stink a lot. Lloyd cites information establishing six years of at least a perception of tight housing in Madison. All summer, I heard stories about Madison houses going on the market and selling in days. A friend said a California family bought a house for their daughter just for her to live in while studying at DSU.

If there's all this demand and so little supply, why isn't the market solving? What's stopping tool-belted entrepreneurs from putting up sticks and making easy money? Madison's high property taxes? Madison's high utility hookup and service charges? Madison's collusively low wages that that keep new workers from qualifying for mortgages?

Something is holding the market back in Madison. Do we really need government intervention via TIF to solve it?

I shouldn't have a beef with the tax increment financing concept itself. The developers and owners still pay property taxes. Their taxes still pay for public improvements, not private property that they can up and take with them or sell for profit, but streets, curbs, sidewalks, sewer lines, and other infrastructure that the community owns and benefits from. And there is merit to the notion that new housing is a useful component to a comprehensive economic development strategy.

But when we look at the big picture, TIF is a free ride. Go east on Eighth Street two blocks. You find apartment buildings there. I don't know who built them or when, but the developer of those buildings didn't get a TIF district to help make those apartments happen. That developer managed to cover his own construction bills and still pay regular taxes to support the city, school district, and county. TIF removes half of that burden from new developers, giving them an unfair advantage as they enter a tight Madison housing marketplace that ought to be drawing hordes of builders and buildings without taxpayer help.

The Lake County Planning Board apparently isn't too worried about exploring the mechanics of Madison's market failure. The board yesterday recommended the TIF 2 plan for approval. The Lake County Commission will take up the matter on Thursday, September 19, at 10 a.m.

p.s.: Lloyd is requesting this TIF through the county rather than through the city that completely encompasses the proposed district because, with one TIF already going, if the city financed this project, it wouldn't have money left to accept any more TIF requests. (Hmmm... is another ask in the chute for the city commission?) The county has a TIF for Dakota Ethanol on its books, but it still has more fiscal leeway to undertake this TIF #2.

TIF plans are welfare for the rich. Part of the Nanny State for those connected to the plutocrats and sycophants in governments claiming to be democratic but leaning more toward corporate facism.

We want some money too. Instead of getting any of this project money we are paying money towards it with our taxes. Yep, we are competing with our own money. There's got to be a reason that one specific person can do this project with over $400,000 paid not by him but by TIF. Take a good look at the independent person who has sunk so much into making a grade school into nice apartments. No money given to them by the city or county. How about the people that have rentals - all could use a share of the money and we paid our own curb and gutter and land work with the promise that the road would be done (didn't happen for us-it is still gravel and not a good road). I still believe that the "good old boys" club is very much in this county and city and it isn't going to go away anytime soon. It 's hard to accept the politics of this area. Yes, we have rentals and so do many others in the community that could use help. Let's just have the city/county go into all of our businesses and forget the people and businesses in this area that are run by families, etc. They keep raising taxes to pay for the pet projects. Like it or not they have skewered ways of handling things. Who gets the rental monies from this project. Oh, I know I know!

Yep. When the suits representing big business come asking for free taxpayer money they always find the door open for their proposals. Small businesses make due without the handouts that big businesses feel entitled to.

Mom, you should get some friends together and attend next Thursday's county commission meeting. Better yet, contact your county commissioners and take them out for coffee before the meeting.

Couldn't agree more with Mom above. Madison should not be lured by the "appeal" of Lloyd and what they offer. Sioux Falls Commission and City Council are just mesmerized by Walmart and all the pocket lining they'll be doing (or not). I would hate to see Madison have Lloyd come in and have the same thing happen...

28 apartments huh? A lot more than a couple of duplexes that was told would be going there.

Just another pipeline of Madison dollars going back to Sioux Falls.

The LAIC helped bringing in a Sioux Falls company, which is good. But provides no jobs and no dollars will be put back into the city.

Casey, you raise an interesting point about economic development choices. The apartments themselves create no ongoing employment. They house workers, but they provide no guarantee that those workers will be new people with new jobs. See, for example, TIF#1, where a local gal with an existing job moved into one of the first houses built. I don't begrudge her a nice place to live, but when I put on my green eyeshade, I don't see the TIF providing a direct gain in jobs. That's why the TIF and economic development statutes direct local governments to spend their money on commercial and industrial development, not housing.

To top it off, the money from this TIF gets siphoned out of the county. Madison people need a place to live, and if no one locally is going to take the risk and build, then Lloyd might as well fill the gap. But spending tax dollars to to boost the margins of a well-off Sioux Falls developer who doesn't need the help is a sub-optimal solution.

As Mom mentioned, couldn't possibly be the local politics and policies that have turned off local mom and pop businesses maybe? Its tough to want to invest more into Madison when each time you turn around there is a tax hike for something on property owners.

THE LAIC saw a need, which is true. With Global, hospital, etc coming in there will be a short supply eventually. And in all honesty a lot of the apartments available in Madison aren't exactly what you call "new". This will attract college students as well. Its smart business what Lloyd is doing, its just sad that its all foreign investors doing it. I honestly think the local politics have turned off the local rental investors for the most part.

Its just funny how this was suppose to be a mediocre project was actually a 2 million dollar 28 unit project by a huge property developer out of town and now using local tax dollars.

My rant. :)

That is my biggest gripe is that local tax dollars would be used in any shape or form. If Lloyd sees a need (which there is), great; use your own $$ to fund it. They'll make their ROI in short order.

As TG says, there's clear and quick return on investment. But Lloyd, with so many other holdings and revenue generators, can take it or leave it, right? Is that the reason Lloyd is willing to make the pitch when no one else in the local market is jumping to fill the gap? And If Lloyd looks at our county commissioners and says, "No TIF, no project," how is a commissioner supposed to vote?

Casey's statement, that "the local politics have turned off the local rental investors," certainly fits with what local rental investor Mom is saying. I wonder: does voting for the TIF only further turn off local rental investors, disincentivizing them from making any more investment in a system where their tax dollars fund their competition?

Competition? like when the got involved with the DSU complexes and guaranteed rent on them if they sat vacant? Already have competition within each other locally the last thing people like Mom and other investors want is to compete with government money. It is of my understanding when my father sold this land this spring it was going to to go for a few apartments. The price and land was negotiated by the LAIC. Didn't have a clue it would end up in Lloyds hands, 28 units, 2 million dollar project, and tax payer dollars. It was a complete shock reading your blog yesterday Cory to us.

LAIC negotiated this sale? And the land was your dad's? Please, Casey, tell us more!

Like I said. It is of my understanding. Julie Gross came to my dad with an offer, and it was accepted. At the time was told apartments were possibly going to be built but didn't know by who or the scale or anything. I don't know how involved the LAIC was or anything but enough toget it purchased from my family. Since I wasn't there I do not want to overstep but state what facts I do know.

And the land was sold this spring. So they are moving pretty quick in my opinion.

There are people that pay to live somewhere.

There are people that are paid to live somewhere.

And there are those that will be paid by everyone else, "in one way or another," to build the housing for those other two kinds of people.

The rich keep getting richer and the poor keep getting poorer, that's life unless we can change the formula. I really do feel for you people that have to deal with TIFs to make someone else rich, but then it's happening all over the place now.

Can the formula be changed? Don't know. This state will be one of the last if it can.

Cabela's, Walmart, and Lloyd whoever the hell that is are all moving to your neighborhood. I would guess everyone knows how the natives felt way back then.

http://grooveshark.com/s/My+Neighborhood/3LVugq?src=5

The Blindman

If I was on the Lake County Commission, I would vote against this TIF. How can this area of Madison be a "blighted area" when a $37 million project broke ground this week just 2 blocks south of this proposal?

Casey, get your dad online, let's hear from him!

In the LAIC's... well, let's not say "defense," but let's consider possibilities: When Julie Gross came to your dad with LAIC's offer, they may have had apartments in mind, but they may not yet have gone out seeking specific bids from developers. So what they told you at that time may ahve been accurate according to what little information they may have had.

Then again, would the LAIC set the plan in motion if they didn't have a solid result in mind, if they hadn't had the conversation with developers about just how much return they could get on the land?

Charlie, excellent point. We're hearing the new hospital touted as an engine of economic growth. Shouldn't that engine be able to pull that load on its own, with all the subsidized loans it's already receiving, without further taxpayer subsidy in the form of a TIF? Have you talked to any commissioners, Charlie? Any sense of where they may stand on the TIF?

I live in Sioux Falls and a lot of Lloyd's properties aren't affordable for a lot of people. I also think that if developers want to develop property they should be responsible for creating the roads, running sewer, etc. unto the property. They could charge a little bit more for rent to make up for their costs. There is another thing to consider how many people that would move into those apartments would actually be working in Madison? There is a good possibility that they could be working in Sioux falls, or other towns, which means that those people wouldn't be spending a lot of money right in Madison.

Responsibility for roads, sewer, etc. might also lead to more rational design.

Joan, do you have a ballpark on thos unaffordable rents? Madison neighbors, what rent do you think will be affordable for all those apartment-hunting workers the TIF district is supposed to house?

And Joan, while Lloyd would have to charge less rent than it does in Sioux Falls to attract those SF commuters, that is another flaw in this plan: it makes a lot of assumptions about economic benefits that the project itself does not guarantee.

Houses are still extremely affordable in Madison. Just last weekend I saw one that needed a little bit of paint/etc go for 20,000. A steal. You can still find homes under the 50k mark in town. Anyone who can afford the rent that Lloyd will ask can afford a mortgage in town. Just a thought.

Well, there's a lot of people that don't want any maintenance and they want modern updates, and probably a surprising number of people have more money to spend than we realize. That said, we have wage earners who make less than other towns in our area and our housing market to buy can be out of reach for them even though our cost of housing is low (or they don't want to buy), again compared to other towns. I've stuck to the point Madison needs higher wages to be in balance with Brookings and others.

A 20k house is an anomaly that needs a lot of work, in the floodplain, or something odd that won't pass an inspection and get a mortgage. The lowest price house on Homeview is 35k on SW 4th, the one for 49k needs a lot of work, and the things in the 70s right now are, well, look livable (haven't been in them). Look for yourself.

I'd take a home in the 50-70k area with a mortgage/ins/tax payment for the ballpark of $700 on a 15 year than the cost that these Lloyd apartments will be asking for (which I hear will be in the same ballpark area). Granted they wont be up to date, nicest homes, but a home and an investment with a return down the road. But that's me personally. But your right John, not everyone likes the idea of home ownership. I never agreed with the idea of throwing money away on rent and in 10 years have not a dime to show for it. But your landlord will thank you. ;) haha.

Yes Casey, that's how you (and I) think. But contractors and realtors tell me that buyers today do not want sweat equity. They want move in ready. Years ago buyers would install the kitchen cabinets, finish off the trim, paint the house, but most buyers don't want to do that anymore (and I'm not criticizing). People have busier lives and often both parents work.

If you own a home for 10 years you'll probably come out ahead, but with repairs along the way and the high cost of selling a home (commission, title insurance, unexpected costs like radon or who knows what, a crash maybe) renting can really be the right answer for a lot people. They are mobile, even around here, and I'm told younger people aren't in to owning stuff like the older generations. As we've seen there may be no sense of security in owning a home, or quite to the contrary, so the decision to buy needs to be a calculated one.