The conservatariat is bracing for battle with the unholy alliance of liberal barista Steve Hildebrand and vengeful Reverend Republican Rep. Steve Hickey, who plan to launch an initiated measure to cap interest rates at 36%. (People love coffee, and people love Jesus; payday lenders, you're toast.)

The conservatariat is bracing for battle with the unholy alliance of liberal barista Steve Hildebrand and vengeful Reverend Republican Rep. Steve Hickey, who plan to launch an initiated measure to cap interest rates at 36%. (People love coffee, and people love Jesus; payday lenders, you're toast.)

P&R Miscellany and Troy Jones both lay out the business justification for high rates and fees for short-term lending. Both say that the Hildebrand-Hickey initiative will put payday lenders out of business. P&R, to his credit, does not deny that payday lending "is a defective instrument or that it is sold to the ignorant and unsophisticated."

Rep. Hickey acknowledges his initiative would kill the exploitative payday lending industry. He says they asked for it:

A 36% cap puts payday, title and signature loans shops out of business in SD. Last year they had the opportunity to cooperate with our coalition and implement reasonable regulation that would have curtailed their biz by 20% but would have kept their doors open and profitable. The voters will have an opportunity to decide their fate [Rep. Rev. Steve Hickey, comment, P&R Miscellany, 2014.11.28].

Jones runs deeper numbers than P&R, then peers up through his green eyeshade and posits an argument he's shared with us before: payday lending serves a market need, and putting them out of business will make borrowers lose their jobs and their kids go hungry:

It is easy to assert that 36% APR is usurious. But, deep in my heart, I believe this industry serves a need that is important to those who utilize this source of credit. Rather than resorting to emotional bromides of who cares more about the poor, if we are going to appeal to this emotion in a ballot, let’s make sure we are also acknowledging the consequences [Troy Jones, "'We Must Not Resort to the Flame Where Only Light Is Required' (Les Miserables)," Dakota War College, 2014.11.28].

I could reëngage Jones in a discussion of the comparable consequences of outlawing usury and prostitution. Instead, let's talk literature.

The translated quote Jones misappropriates for his title comes from Volume 2, Book 7 of Les Misérables, a lengthy parenthesis (really, Hugo titled this section Parenthèse) in which Hugo dismisses monastic life as an anachronistic sore whose "superstitions, bigotries, hypocrisies, [and] prejudices" we ought to purge from modern life. (Careful, Troy: headlines like that could get you nuked by your blog host for anti-Catholic bigotry.)

To invoke Hugo in an excuse for payday usury is to miss a main theme of Hugo's masterwork: society's downtrodden are poor and hungry because society's institutions are stacked against them and force them to submit to exploitation. Hugo's hero is not a banker who profits from fleecing desperate borrowers; Hugo's hero, Jean Valjean, is a felon who becomes a philanthropist dedicated to overturning a system that exploits the poor.

In other words, Victor Hugo would probably shine a light on the payday lenders and vote for the Hildebrand-Hickey initiative to put Dollar Loan Center out of business. (Jean Valjean would likely help the revolutionary Enjolras burn Dollar Loan Center down, but let's leave the fictional flaming to the Republicans, shall we?)

O.K., so we have the coffee crowd, the Jesus crowd, and the French lit crowd on the side of an interest-cap initiative that would give every citizen a legal protection that federal law already gives to soldiers and their families. You'd better polish up that business case, Troy; you're running out of constituencies!

Un couvent en France, en plein midi du dix-neuvième siècle, c'est un collège de hiboux faisant face au jour. Un cloître, en flagrant délit d'ascétisme au beau milieu de la cité de 89, de 1830 et de 1848, Rome s'épanouissant dans Paris, c'est un anachronisme. En temps ordinaire, pour dissoudre un anachronisme et le faire évanouir, on n'a qu'à lui faire épeler le millésime. Mais nous ne sommes point en temps ordinaire. A monastery in France, in the full noon of the nineteenth century, is a school of owls confronting the day. A cloister, in caught in the blatant act of asceticism in the very heart of the city of '89, 1830, and 1848, Rome blossoming in Paris, is an anachronism. In ordinary times, to dissolve an anachronism and make it vanish, one would only have to make it spell out the date. But we are in no ordinary time. Combattons. Let us fight. Combattons, mais distinguons. Le propre de la vérité, c'est de n'être jamais excessive. Quel besoin a-t-elle d'exagérer? Il y a ce qu'il faut détruire, et il y a ce qu'il faut simplement éclairer et regarder. L'examen bienveillant et grave, quelle force! N'apportons point la flamme là où la lumière suffit. Let us fight, but let us distinguish. The particular property of the truth is to never be excessive. What need has the truth of exaggerating? There is that which must be destroyed, and there is that which needs simply to be lit up and looked at. A kindly and serious investigation—what power! Let's bring no flame where light will suffice. —Victor Hugo, Les misérables, tome 2 (Cosette), livre 7 (Parenthèse), chapitre 3 ("À quelle condition on peut respecter le passé"), 1862 —translation, Victor Hugo, Les Misérables, volume 2 (Cosette), book 7 (Parenthesis), chapter 3 ("Under What Condition Can One Respect the Past"), 1862)

I don't understand why the Post Office can't provide such service, they would have the funds available to make such loans and wouldn't need to charge 300% to be profitable. It would allow the Post Office an additional revenue stream to help with their current financial situation and also provide a needed service minus the loan sharking.

Now DWC has Cory on his heels: it kinda makes me want to puke.

Larry, did you not have your coffee this morning? You seem a bit more gruff than usual today. ;-)

(Who's on whose heels, Larry?)

Where is the solution to the payday lender debacle in your post, Cory?

At least Jones is admitting that it's all about business, even when it comes to our most vulnerable. Really, is the payday lending industry that big of an industry in SD that Mr Troy is worried about all these jobs being lost? Kind of sad isn't it? Mr Jones is talking more like a lobbyist for payday lenders. Thanks for the chuckle this morning, Troy!

I guess the only problem with the postal service doing this would be the GOP trying to put them out of business so they can privatize the mail.

The concept of the Post Office providing minimum banking service for those who don't have bank accounts has been written about for a while now. Privatizing the Post Office so that it runs 'more efficiently' is a joke. Stop expecting the Post Office to pay into retirement 20 years in advance and set up minimal banking for it to administer would be two great steps to keep it going.

Forcing them to pay that retirement up front along with not allowing the PO to implement several changes that any normal business would do plus requiring them to do many things while not providing any funding at all is how the GOP is forcing them to go broke. Once this happens then they will try to privatize because we all should know that no profit goes uncollected by the GOP.

Mr. Tim, do you really want the Government in charge of short term loans to people who would take them? There are twice as many math impaired people than just the group that takes payday loans. The other half play the lottery to try and strike it rich. You would be giving the Government total control over the loan-sharking, the gambling, and the free gravy train of welfare these people live on.

Grudz, safeguards would have to be in place like any other loan business, I was just tossing it out there for consideration. It might be a better alternative to the legal loan sharking we have now. Technically, the Post Office isn't a part of government and receives no funding from government, they just have to follow idiotic rules that would break any business.

Good stuff on the misappropriation of the quote. Thanks for supporting the rate cap!

Perhaps Mr. Hickey would consider creating a state post-office, Tim, which could then follow the new rules he lays out and put those other fellows out of business the old fashioned way. By crushing their spirits using a better product and a cheaper price. And better customer service to boot.

Not sure about the legalities of that grudz, but I would support something along that line.

So Pastor Hickey, when can we read a draft of the bill? Also, do you consider the loan origination fees as part of the overall interest rate? I notice Troy does in his argument, but I'm not clear as to where you stand. As per our DWC discussion, it does make quite a difference in the context of small numbers. Looking forward to reading and discussing the text of your initiative in detail.

I would rather trust the post office than wall street with my loot. We actually had a working system not that long ago, we should bring it back. http://www.slate.com/articles/news_and_politics/history/2014/08/postal_banking_already_worked_in_the_usa_and_it_will_work_again.html

Has anyone considered that we could have short-term lending without the high interest? Seriously, what is the problem with giving people in a bind the same interest rates as regular borrowers?

Probably the effort, Mr. ck, is as much hassle to make a short loan as a long one. And the risk of not getting paid back might be bigger. So what Mr. Hickey wants to do is squeeze these people out of making a rich profit on poor people who make bad choices because he feels it is not ethical. And I'm OK with that. But it will anger the poor, bad choice making people who take out these really stupid loans. But they don't read the news anyway and won't know about it until it's too late.

Larry, my solution is the same as Hickey's, Arizona's, and Montana's: cap interest rates or outright ban payday lending. Payday lenders apparently find ways to skirt the laws and keep exploiting people, but we don't have to make it easy for them.

As for Troy's assertion of market need, I take the same tough-love position I hear conservatives take on welfare: we mustn't breed an unhealthy dependence on this deceptively easy money, especially when loan sharks make exorbitant profits off this dependence that exceeds the wildest jollies that conservatives fantasize we liberals get from enrolling more people into food stamps.

CK, I'm actually willing to accept the analysis from Jones and P&R that you can't sustain a short-term lending business on the same interest rates as long-term lenders. There's more risk; there will be more defaults.

If I may offer an indelicate analogy, consider that hookers don't turn tricks for the same rates that they charge their significant others. "Wait a minute," you say, "hookers don't charge their significant others anything!" Exactly. When they're with their significant others, they face much less risk and much more long-term accountability. Hookers charge their clients $260 an hour to compensate for the much greater risks they face in their professional activity.

And since their professional activity fosters exploitation and outright slavery, we ban it.

Bill, the initiative that Rep. Hickey submitted for approval to the LRC last year but never circulated read, in toto:

"No licensee may contract for or receive a finance charge on a loan that, if expressed as an annual percentage rate, exceeds a rate of thirty-six percent. A violation of this section is a Class 1 misdemeanor."

As an addition to SDCL 54-4, this law would not have applied to state banks, national banks, bank holding companies, other federally insured lending outfits, or South Dakota chartered trust companies.

So banks could do loansharking in Mr. Hickey's world but not those places next to the alley over by the casino? But banks could. Is Mr. Hickey in the bank lobby?

I am quite comfortable with my title. Representative Hickey wants to put Payday Lenders out of business. I suggest taking a flame is an over-reaction when all that is needed is a light, the light of understanding and study.

Maybe the industry does more harm than good. I am waiting for ANYONE to provide analysis the demonstrates it. I am waiting on my own post for some basic questions I've asked Steve which I am sure is readily available and will be provided soon.

This will help all of us at least be better informed and not react viscerally.

Context, Troy, context! :-)

Folks, Troy has laid the gauntlet at our feet. Simple cost-benefit analysis. Numbers! Go get 'em!

My viscera shall remain wholly engaged.

The term “usury” contains a moral element. It means enriching one’s own wealth by exploiting the misfortunes of others. In the early years of our country, usury was forbidden and it meant charging any interest at all for lending money. A usurer was considered the lowest form of parasite.

People who take out payday loans do so in desperation, usually to pay a bill so that their utilities won’t be cut off, or to make a car payment for a vehicle needed to travel to work and tend to family, or to avoid threatened action by some bill collector. Our entire financial system is usurious now because it puts the most burden of interest and fees on those who can least afford it. It is an emblem of our moral transformation that reveres greed and shamelessness as what comprises good business.

I am acquainted with payday lenders both through efforts as a political volunteer and in working with a denominational social agency. We don’t’ need payday lenders. Let them join the ranks of those desperately trying to buy stuff or basic subsistence or to prevent the denial of food, shelter, and the means of making a living. People who take out payday loans are the working poor who confront the disabling effects of poverty.

Our financial system exploits students with loans. It builds arguments as “good business” for the further devastation of those trying to survive on poverty-level wages. We have so much to be proud of.

The answer for these people is to work harder.

Get out there and work harder people. Or more. Or even at all.

From the non-denominational book of Mark: "Do not lie with the loan sharks, said Mark. For he who lieth with the loan sharks is stupid."

I don't like using the words "loan shark" in describing payday lenders. I grew up in an eastern state and an area that had well established organized crime families.

Almost everyone knew who to go see for a loan with no questions asked. There was no paperwork but the details including the penalties (sometimes physically painful) were explained in simple terms with no gotcha fine print. In most cases the loan could be extended for an indefinite period as long as you paid the weekly interest.

Payday lenders give loan sharks a bad name but how much different are they than some legitimate business that offers no interest financing for a specified time on your purchase if the loan is paid in full during the interest free period. One of our local mega furniture stores has this type of sale several times a year. They sell your loan to a bank that will charge you 29.9% interest on the full amount from the date of purchase if you fail to pay off the loan during the interest free period.

David, a usurer should still be considered the lowest form of parasite. And W R Old Guy, they are loan sharks. The only difference is one parasite offered extreme interest loans to economically stressed people to exploit them as a member of a criminal element. Today, they exploit the same people because people in South Dakota are stupid enough to institutionalize criminality.

And while that brings to mind, Mike Rounds' Racketeering Scam, I will not digress.

Grudz, please define "work harder."

There are people who do work hard to fulfill their job duties, and do their job well. Working harder does not necessarily translate into higher pay.

That's right, West River Old Guy. They live on the vig and don't really care about the nut. Mr. Hickey's bills will be all about how little the vig can be and paying back the nut. Mr. Hickey thinks he is looking out for these people who make bad choices.

I don't get this. Wingnuts whine that welfare for the needy is too easy to get,but it is ok for loan sharks to have access to people that can least afford loan sharks. Sounds like a bunch of frigging morons to me.

Isn't that Lederman fellow from down your way, Mike? I don't really think he's much of a wingnut, even less than Mr. Hickey who has proven he's a bit of an overgodder but less than most. Bailbondsmen and loansharks run in the same church circles, you know. Well...maybe not exactly, but same social clubs perhaps.

What would really be interesting is knowing at what income levels are those who get these kinds of loans. Is it only those who earn $7.25 per hour, or does it include people who earn more, but had a pressing need to pay for services that were unexpected? For example, sewer pipe breaking, or a vehicle that breaks down on the interstate, or someone needs to purchase medical equipment for a loved one who does not qualify for assistance, or needs the equipment before the paperwork is processed and approved.

As long as people know exactly what they are getting into when seeking a loan, and how much it will cost, people need to be able to make that decision. What other options are there when money is needed during a time of crisis?

I think people who make bad decisions make bad decisions and waste their $7.25 and hour if they make $7.25 an hour, or waste their $12.34 an hour if they make $12.34 an hour. People who make bad decisions like that do tend to probably be on the lower end of the earning pile but I don't have statistics like Mr. mike on that. I just believe that to be true.

Mr. H's blog seems to be broken again. I get many errors and I don't understand what to do after they say the error. It seems like there are problems.

Mike - "Wingnuts whine that welfare for the needy is too easy to get, but it is ok for loan sharks to have access to people that can least afford loan sharks."

Very true.

I'll respond to Troy's questions at DWC in a day or so - I'm working up a response and have asked for some data that will help this dialog.

Maybe when our vehicles breakdown we can just run to Mitt Romney's car elevators and borrow some of his excess vehicles.

People who have nothing go to loan sharks out of desperation and the loan sharks have the full faith and credit of gubmint law enforcement behind them for some damn reaso0n.

Grudz, it is a stereotype that only those who earn low wages use payday loan services, maybe it is a valid stereotype, but maybe not.

It could be that it is only those who earn the $7.25 per hour who run into problems paying back the loan, or only those who earn $7.25 make bad decisions, but with the high number of payday loan type business in Sioux Falls, it it hard to believe that it is only those who are low income, or bad decision makers who uses these services.

That is what I think would be interesting to have the statistics for.

What you need to do Grudz, is to "copy" (Ctrl and C)your comment before you submit it, then when you get the error message use the "return" arrow, and try again. Sometimes, you have to do it two or three times because there are others who are posting at the same time. If that does not work, then go back to the main page, click on the topic of interest, scroll down to where you can add your comment then paste (Ctrl and V.) During times of high traffic on the web-site, there is more chances of getting the error messages. Wait until the traffic congestion decreases, and the interstate will be clear sailing. :)

Or bad decisions, Mr. mike. Maybe they made some bad decisions and we can't save them from being stupid. It is sad, but true.

grudz,

I know families that do work "harder", sometimes at 3 or 4 different low paying jobs just to make ends meet, they are forced at times to get caught in the snare of legalized loan sharks.

Steve Hickey,

Why are you a Republican in South Dakota. The SDGOP stands for rewarding amorality and criminality. While I know that people are complicated, you strike me as a decent sort who knows what is right or wrong. The Democrats in South Dakota are centrists in any other state, or would be considered as a group as conservative Democrats. I appreciate the strategy to change the corrupt SDGOP from within, but you don't strike me as someone who's willing to run around in wolves' clothing just to be a member of the Wolves Club.

I think it is somewhat interesting, that there are bad decision makers who consume alcohol, yet there are no attempts to regulate the businesses that sell alcohol.

Someone with DUI convictions can still purchase alcohol. Someone who has a history of being "mean"/abusive drunk, can still purchase alcohol.

Grudz, it is true you can't save them from being stupid, but you can make it harder to take advantage of that stupidity.

You are right, Mr. Tim. The people are bringing my dinner now so I need to eat it. It has carrots. I don't like carrots but I will eat them.

Enjoy your dinner.

http://projects.aljazeera.com/2014/payday-nation/complaints.html

This is just from online lenders.

Years ago I worked as a community organizer in high poverty areas in Oklahoma, one of the things our team did was to form various kinds of community co-ops; food coops, arts and crafts co-ops, and community based credit unions. We tried to use non-denominational churches for the credit unions, that helped with issues of trust. Credit unions are easy to organize and usually supported by the state, South Dakota at one time had some good information on them.

Community credit unions do not operate in the same manner as the federal credit unions that are actually banks.

Another source is to use are community banks that usually offer better services to the working poor and the poor who maybe need a check cashing service.

Hopefully the two Steve's IM will win, but I doubt it. South Dakota is hell bent on screwing the poor and working poor and penalizing them for their position in society. Regardless of how the how loan shark legislation works out, we have to have better solutions.

No matter how hard you may work, there is another willing partner to take your hard working dollars, the casino machines.

Yes, Grudz, having a medical illness and all the bills that come with it is a person's decision. Medical bills is a biggie when it comes to reasons why people turn to their credit cards and payday lenders.

Credit cards are one thing, Ms. Jenny. I don't think Mr. Hickey wants to outlaw credit cards.

Payday lenders are another thing.

Both, if used stupidly, can wreck a woman. I blame the woman.

Not all the users of payday lenders are low income. I know construction workers that earn in the $30.00 per hour plus range that use payday lenders. They are not the best money managers and have some self inflicted loads to carry such as child support for multiple children from several different mothers, loans to other family members, and other issues. They do not put any money aside so a few days of no work due to weather or longer terms of not working due to lack of contracts puts them in a bind. They prefer to deal with payday lenders rather than a bank or credit union as there are fewer "hassles" to deal with. Many will have more than one loan by using different lenders. They do file and collect unemployment for days they do not work but it's a lot less than their usual check.

I've worked with young(mostly) folks wound up in high interest loans of different sorts for many years and it comes from those of all financial abilities. To me it is little different than those deep in the gambling debt driven early on by easy credit. Always looking to make it all back with just another $50 or $500 or $5000. If I just had.......

.

Payday lenders provide no service to their customers. Simply, learning restraint, would come much quicker without.

.

Btw, check out the furniture and appliance dealers or used car dealers selling the loans with the products...many are impossible to maintain with their highly inflated prices superimposed by the low appearing interest rates.

I've worked with young(mostly) folks wound up in unserviceable or high interest loans of different sorts for many years and it comes from those of all financial abilities. To me it is little different than those deep in the gambling debt driven early on by easy credit. Always looking to make it all back with just another $50 or $500 or $5000. If I just had.......

.

Payday lenders provide no service to their customers. Learning restraint, would come much quicker without.

.

Btw, check out the furniture and appliance dealers or used car dealers selling the loans with the products...many are impossible to maintain with their highly inflated prices superimposed by the low appearing interest rates.

How does this happen, Cory? Timed out and then two posts?

Prof. Newquist said, "It is an emblem of our moral transformation that reveres greed and shamelessness as what comprises good business."

Indeed. Very well stated sir. Amorality is the new Wealthy/Republican virtue. I don't think Bill Bennett included that one in his pompous Book of Virtues.

Mr. Les, both Mr. H and PP are having a lot of blog issues lately. I do not know how all this stuff works but I saw on the news about people attacking ebay and target sites and with the holiday sales it will only get worse. I bet you dollars to donuts that these two blogs are both facing some big out of state web attacks and fending them off over the retail season is going to take a lot of computer powers. I just click the retry button when I get those errors here. PP's blog has gotten so slow I fear it is infested with bacteria and things that slow my computer down.

God speed Pastor Steve!

When the GOP in Pierre push back I will wonder who they worship more. My vote is on money, party and business trumping their priorities and supporting the sin of usury will win out.

Les and Mr. West River Old Guy; you both are well old enough to know exactly what is wrong with these people: They are making stupid choices. They will continue to make stupid choices. Hand them some of your loose change and walk away, not looking back or bonk them on the head and grab them by the ears and scream into their faces, spittle flying!

Grudz, my friend. I've noticed that your usual first response when bad things happen to people is that they did something wrong. They made bad decisions, were careless or stupid, etc. Sometimes that is the case. Shouldn't those people get a second chance? A third? Those usurious interest rates may cheat them out of that additional opportunity.

*But much more important Grudz, the most common causes of financial hardship are none of those reasons. I just Googled "Why people go bankrupt." The top two most common reasons in each of the top 6 sites were first, medical expenses, and second, job loss.

It's not personal failure Grudz, it's getting sick, getting down sized. The people having the hardest time getting a job today are folks who were down sized during the Great Recession. They have applied for many hundreds of jobs since, but prospective employers don't want to hire the long term unemployed.

There are real victims of the Culture of Greed Dr. Newquist described so eloquently in an earlier comment. There are hundreds of thousands of people who are suffering. I know some of them. Most of the people I work with are struggling for a variety of reasons. Because of the work I do, I know their medical, financial, familial and other in intimate detail. I know if they are lazy bums, or not. A very small percentage are. I've been doing this in MN since 2008. One, I said ONE of my clients was a cheat.

Grudz, I hope that you'll be a little slower to condemn such folks in the future. I hope everyone will be a little kinder in their assessments of people who are doing whatever they can to have the basics - food, clothing and shelter.

I believe, Ms. Geelsdottir, deep in the bowels of my sinewy, almost plastic heart, every single one of the people in question have had numerous chances.

Hear, hear Deb, you did that nicely.

I have seen a numerous times the bankruptcy approval forms of people who have gone into bankruptcy because of major medical expenses for themselves or their loved one.

You young ladies like to hate on an old man like grudznick because you are still soft in the heart and have not had the painful life experiences I have. My brain is less open and more calloused to the bleeding hearts out there that lie and scheme.

Grudz, thank you for the compliment of writing that I am young, you are a sweetie. I have had many, many painful experiences, perhaps even more than you, and in many different ways.

I have learned that suffering tends to do two things to people, one is that they become more compassionate, and a little more willing to extend a gentle and generous hand. Others who have suffered become bitter, hard, and a little less willing to extend a gentle hand.

There are some things that I am a hard a** about, particularly those who use drugs (including alcohol) for recreational purposes because I have seen the ugly of drug use. But I applaud those who seek assistance, yet relapse time and again, but still keep seeking assistance.

What is that expression about forgiving someone 7 times x 77 times?

It is not fun for those who seek payday loans then get caught up in the cycle of increasing debt. The question is what other options are there when people need money during times of crisis/hardships?

Come up with a way to assist those who need assistance during an emergency, then we can focus on ending the payday loan system for those who use it for recreational purposes.

Grudz, I respect your opinion. I suspect we have had a variety of experiences, and our vision of each varies.

It is not naivete that leads me to my conclusions; it is cold, hard, facts. You are the one relying on emotion. I told you I have unfettered access to everything about these people. Yet you, based entirely on emotionalism, say "deep in the bowels of my sinewy, almost plastic heart."

It appears that you, Grudz-on-whom-I-have-never-hated, are the one who is "soft in the [head]."

JeniW, I share your observation about the ways people react to hardship. One can never tell by looking, or listening, what kinds of hardships another has endured. One of the things I have learned is that it is fruitless, and perhaps even demeaning, to play "I had it worse than you did."

To be perfectly crystal clear, I do not think you or Grudz are doing that.

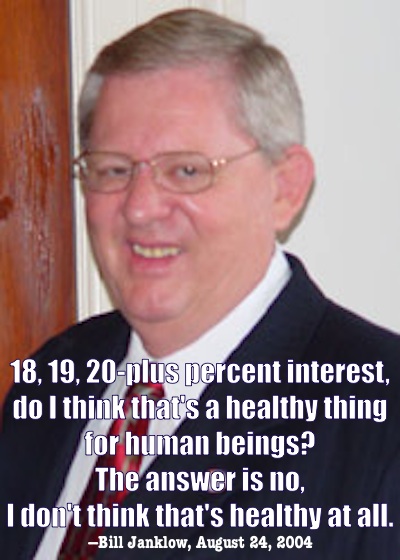

Cory, did you Have to use that picture? It's so unpleasant to look at. Ugh.

Cory, the theme of the quote is perfect. :).

The hypocrisy of the GOP and it's leaders continues to amaze me.

Think of it...we fund our schools, care for our most vulnerable and give corporate welfare to wealthy businesses to hire people who need payday loans...all on the backs of the sins of gambling and usury.

Troy I respect your faith, but can you tell us what the Catholic church has to say about profiting off the poor, gambling and usury?

What does the Church say about those who ignore the teachings when it is more convenient to serve another master?

In the most recent edition of "The Lutheran," the denominational magazine of the Evangelical Lutheran Church in America, columnist Peter Marty has written about people in poverty.

This is an excellent quote from the article:

"In many respects, Lyndon B. Johnson's 'war on poverty' has become a war on the poor. Large numbers of Americans want to punish the poor for their poverty."

Here is the link to Rev. Marty's article:

http://www.thelutheran.org/article/article.cfm?article_id=12311

In the resource I just mentioned is a wonderful explanation of the verse participants in the War on the Poor like to use. Jesus said we'd always have the poor with us. Remember that one? Yeah, Jesus was talking about something from the Hebrew Bible, aka-Old Testament. He was a scholar par excellence and so it's not as simple as it seems.

Read the article and learn something new.

Jana, the Catholic Church that I grew up in would be against everything payday lenders stand for.

Troy needs to practice more of the social justice side of Catholicism, than looking out for business owners using people in desperation to profit off of.

isn't grudz stupid for thinking the poor are stupid, believing age and experience makes him right?

I appreciate Deb's Lutheran point about the underlying desire to punish the poor for their bad choices. Victor Hugo would say, "Quelles choix?"—What choices? Many of these folks have been force into desperation by social institutions that leave them no healthy, humane options. Instead of seeking to punish (which always includes an inherent affirmation of our moral superiority, because by what right do you deliver punishment if you are not somehow higher in authority?), we need to swallow our pride and look for ways to help people in genuine dire straits.

JeniW asked about the income levels of payday borrowers. According to a blog post on a white paper from the Consumer Financial Protection Bureau (you know, Elizabeth Warren's really good idea!), "Only 4% of payday loans are made to consumers earning more than $60,000 per year. Meanwhile, more than two-thirds of payday borrowers have annual incomes below $30,000. The largest chunk of borrowers came from those making between $10,000 and $20,000 per year; this group accounts for nearly one-third of all payday loans."

In cause for further alarm, "The median borrower takes out 10 payday loans in 12 months and pays a total of $458 in fees on top of the original amount borrowed." That means a majority of payday borrowers are using payday loans for chronic shortfalls, not for one-time emergencies.

Thank you Cory.

Jana and Jenny,

Maybe you have read my post on DWC and my responses. Maybe you have not. However, my views on this has nothing to do with the lenders and concern about them. My views are wholly grounded in my experience and analysis that abolishing this industry with this rate cap will do more harm than good to the poor. Agree or disagree with my conclusion, I don't care. But my motive is 100% connected to pursuing the preferential option to the poor. I don't lecture you on your personal morals or conformance to your faith. Just debate the issue with facts and not innuendo and ad hominem attacks.

If payday loans were to be made illegal, would that create the same situation of if abortions are made to be illegal, that is, would people seek the black market to get what they need/want?

The State of South Dakota in a indirect way benefit from the payday loan businesses because people use the money to purchase goods, which the state collects sales tax from, or if people use the money for gambling, the state collects revenue from the proceeds of gambling. How likely is it that the legislators are going to make the payday loan business when it means that the state will lose revenue?

I think it sucks that the payday loan businesses charge high fees, and interest rates, but I cannot imagine the legislators passing a bill that would lead the state in being able to collect less revenue.

Anyone believing South Dakota will stop predatory lending is delusional: it's the Republican way.

Troy, look up St Thomas Aquinas, one of the great founders of Catholicism, and read up on his theories of social justice. These early Catholic teachings are all about dignity, social justice and giving preferential treatment to the poor. These writings are all factual, do you choose not to believe these early writings?

Taking away foodstamps from the poor does them good,how?Not raising the minimum wage or forcing korporate amerika to pay a decent,living wage is good for the poor,how?

We aren't talking bad tasting medicine must be good non-sense. We are talking about real human lives. For some reason christians believe that perpetuating misery for the poor is what jesus would do.

Cory,

Your first comment is neither a negative or positive but a reality. The profile of their borrowers is the working poor whose income and credit history is such that they can't qualify for traditional loans, can't handle normal term loans, and are a high risk of default. Nobody disputes who the customers are of this industry.

Your second point maybe relevant and illuminating with more information, such as the bell curve on this, mean and average amount outstanding. By itself, it is barely more than an anecdote.

But, it raises a point at the heart of what I suspect motivates most against the industry- perpetual use and a debt trap (not unlike these people's more well-off neighbors in a credit card trap). This goes back to the title I selected- light is always good and burning a building down to get rid of rats is appropriate very seldom.

This is an industry that mostly serves the poor. We must be diligent and open-minded in analysis, weigh all pros and cons, and proceed prudently lest we do more harm than good.

Troy, read my blog for a couple of studies, one from UDub and one from the New York Fed, that support your view that eliminating payday lenders does more harm than good. http://theconstantcommoner.blogspot.com/2014/11/i-dont-like-that-we-need-payday-lenders.html

Where is Hickey's and Hildebrand's outrage over bank overdraft charges? Most bank overdraft policies amount to nothing more than a short term loan "interest" more onerous than any pay-day loan. A FDIC study shows that a $20 overdraft with an overdraft fee of $27 translates into a 3520% APR if repaid in two weeks. Perhaps Hickey's time spent in the Legislature would be better served addressing this issue rather than beating the drum for the mob.

http://www.bankrate.com/finance/investing/fdic-study-outrageous-overdraft-fees-1.aspx#ixzz3KepEL5IS

Coyote, who says they aren't outraged? And who says it's an either/or issue? The Steve's aren't the only ones capable of writing bills and circulating petitions. Where are yours? Bring it, I'll sign it.

Cory, per your stats above, it's likely that the 80/20 rule* applies, and it wouldn't surprise me if the ratio is even higher.

(80% of the companies' business volume comes from 20% of it's customers)

Hence a demographic and lifestyle profile of this 20% would be by far the most meaningful in terms of who is most affected by these types of companie, why they borrow, and what their alternatives to Payday loans really are.

Just thinking out loud over here.

Wow, either Hades is now solid ice or the Vikes have won the Superbowl. I find myself in general agreement with Troy on the payday loan question.

Troy & I differ, of course, on the policies of whether to increase resources available to those in need. But we apparently agree that it does more harm than good to take away choices and options otherwise available to those in need.

Instead of outlawing payday loans, or establishing limits on interest rates with the intent of putting these lenders out of business, perhaps we should consider referring people to the existing public option for borrowing short term loans, namely the County General Assistance program. We could make emergency exceptions to the income and resource limits, advertise the availability of CGA, charge a rate of interest that helps fund the loan program, and provide supplemental funding as needed from County or State tax revenue. This would provide a reasonable option that ameliorates the excess interest problem for most people, while leaving the payday loan option available for those who prefer it.

I think JenW hit the nail on the head in comparing this issue to the abortion issue. Making payday loans essentially illegal will only push this activity into the dangerous back alleys and hurt the neediest among us.

Finally, I fully agree with Deb's comment about the circumstances of people in poverty. I worked with the poor from 1978 to 2013, and from my experience the reasons for peoples' trouble are as varied as the people and their circumstances are. I met no "welfare queens," and virtually everyone I dealt with wanted a decent job and a decent income, rather than public benefits. Many individuals and families used public services as a help to the transition to gainful employment and financial independence. Many wanted to work but were disabled from illness or injury that limited their ability to engage in employment.

Indigents are no different than anyone else, and to call them stupid or lazy as a class reflects ignorance, laziness and insecurity in those that impose such judgments and labels.

Maybe there should be a 48 hour waiting period, which must be in the work week (weekends do not count,) and potential customers of payday loan businesses have he receive "counseling" before they can borrow more than $50.00.

JeniW: "If payday loans were to be made illegal, would that create the same situation of if abortions are made to be illegal, that is, would people seek the black market to get what they need/want?"

To some degree yes, but I'm sure the overall impact would be minimized because some percentage of those who currently seek payday loans would opt for using a credit card, seeking more traditional financing, or even reaching out to friends or family if they find themselves short on cash. Keep in mind many people who use payday lenders don't understand all of the fees and costs, and thus don't ever realize how horrible these products actually are until they find themselves caught in a cycle of taking out a loan to pay off another loan in the hopes they can reverse the damage.

However, you are obviously going to have a certain sect of society which has insufficient credit for a more traditional loan or a credit card and may not have a family member or friend willing to help. In many areas, these types of individuals tend to use Pawn Shops as their source of short-term cash. So instead of taking out a short term loan, they pawn a gold necklace or a nice watch... pay their pawn fee, and hopefully find a way to get their item out of hock before it is too late. In some cases they find themselves needing to pawn another item to pay the fee on the first item, and in the end they end up in the same nasty cycle of indebtedness. Hopefully these types of loopholes are addressed in any initiated measure, because if we simply replace the payday lender located in every strip mall with a new pawn shop, we really haven't solved the underlying issue.

In conjunction with such a measure, we also should increase funding for financial education, money management programs, and credit counselors who could work with low income individuals and families. It is one thing to create laws to limit what people can do, but if we don't explain the alternatives we are setting these people up for failure.

Following through on the "target audiences" for these types of loans, I find two key groups with high indices, according among Claritas' P$YCLE market segments as follows:

45 - Greenback Acres

Lower Mid Older Mostly w/o Kids

In Greenback Acres, cash is king. With lower-middle-class incomes and low levels of income-producing assets, members of this segment have relatively few investments, retirement savings, or even credit card debt. But these 45- to 64-year-old Americans do own modest homes--their homeowner's insurance is for under $100,000--which they've used to land home improvement loans. And they show solid indices for buying auto, residential, credit card, and mortgage insurance. Greenback Acres has a high concentration of rural households, and these households like to buy insurance through farm bureaus, banks, and credit unions. This segment ranks high for owning pets and fishing gear, but in Greenback Acres, they pay for everything with cash.

Demographics Traits

Urbanicity: Mix

Income: Lower Mid

Income Producing Assets: Low

Age Ranges: 45-64

Presence of Kids: Mostly w/o Kids

Homeownership: Homeowners

Employment Levels: White Collar, Mix

Education Levels: High School Grad

Ethnic Diversity: White, Black, Hispanic, Mix

Lifestyle & Media Traits

Low mutual funds

Payday loans

Homeowners insurance

Shop at Kmart

Read Country Living

AND:

50 - Urban Essentials

Lower Mid Middle Age Family Mix

The households of Urban Essentials are significant in what they don't do financially. With their lower-midscale incomes and low levels of assets, they rank at the bottom for savings, investments, and retirement accounts. And many of these urban renters go without auto, life, or medical insurance as well. A racially diverse mix of middle-aged urban singles, couples, and families, this group is generally limited in its financial behavior to using debit cards at ATMs. They rarely buy insurance other than renter's or disability coverage. Some members of Urban Essentials are starting to raise children, and they enjoy purchasing toys and reading parenting magazines. This segment also ranks high for listening to gospel music and consuming all types of Black- and Hispanic-oriented media.

Lifestage Group: 02 - Metro Mainstream

Demographics Traits

Urbanicity: Metro Mix

Income: Lower Mid

Income Producing Assets: Low

Age Ranges: 35-54

Presence of Kids: Family Mix

Homeownership: Renters

Employment Levels: WC, Service, Mix

Education Levels: High School Grad

Ethnic Diversity: White, Black, Asian, Hispanic, Mix

Lifestyle & Media Traits

Short term bank relationships

Payday loans

Renter's insurance

Read comic books

Read Jet

Very good points Craig.

Although I was being somewhat sarcastic about requiring counseling before taking out a payday loan, or taking on a credit card designed for those who are of high risk, maybe counseling really should be required, and the individual would have to show proof of counseling before being granted a loan or high interest rate credit card.

Here, you can type in a zip code and see which kinds of clusters are most predominant in your "neck of the woods." http://www.claritas.com/MyBestSegments/Default.jsp?ID=20&menuOption=ziplookup&pageName=ZIP%2BCode%2BLookup&filterstate=&sortby=segment_code&prevSegID=2000#

One way to end Troy's dystopia: Las Cruces is considering a $11/hour minimum wage.

Troy fails to mention that video loottery, Deadwood and tribal gaming feed the loan sharks: it's a typical Republican-driven poverty cycle.

I am reminded of alcohol commercials that ask customers to "drink responsibly." Lottery commercial remind us to "play responsibly." I have no real idea what "responsibly" means in those contexts. A similar question comes to mind for the use of payday lenders: what is the "correct" or "responsible" use for those loans? Given the default rate and the cycling/perpetuating of loans, is a payday loan something that can be used "responsibly?"

If there is a niche need for these micro-loans, it seems like something like a USPS mini-lending option would fill that need -- you know, responsibly.

Larry, it is because of the gambling revenue that the state collects is part of the reason why I do not think the SD legislators will mess with the payday loan system.

The state cannot afford to lose that source of revenue.

Jeni, Democrats Tom Blair and Bill Walsh built the Deadwood strategy: now it spins the meter.

Mr. kurtz, who are those people who use payday loans and then hit the video lottery joints or tribal casinos? They are people who are not very smart now, are they? And, what party to they belong to?

I'm just sayin...

grud, you are the queen: your wife, the regent.

http://www.sdbor.edu/theboard/members/johnson.htm

Do you know what party they belong to, Grudz? How do you know?

I am just being politically incorrect, a rarity for me Ms. Geelsdottir, but statistically correct. Or do you not believe that somebody better at googling than I could find statistics to support my hypothesis? I bet they're out there somewhere, maybe already dug up by Mr. H and blogged here on this blog spot.

Again, I'm sorry that those are the facts. Slap me silly, but I'm just sayin...

Grudz, I'd never ask you to be "politically correct." Never!

What I am supposing is that you are saying most people who gamble and use payday loans are Democrats. Is that right?

What I am asking you is how you came by that conclusion? Is it because most poor people vote Democratic?

One more thing Grudz. Are you saying that people who use payday loans need them because they gamble their money away?

Grudz: http://www.businessinsider.com/proof-republicans-really-are-dumber-than-democrats-2012-5

Now behave yourself. :-)

Bill, you've seen my charts where all of the lower paid welfare dots are blue down in the bottom left and then all of the hard-working middle class dots are red right there in the center, and then all of the high-brow pseudo-intellectual dots who usually work in higher education or as fat-cat administrators are in the upper-right corner, right?

It's the blue dots in the bottom left doing all the pay-day loan stuff.

Some do, Ms. Geelsdottir. Not all, but some. Those are the stupidest ones. Again, there is a huge union of the people who play lottery, are on welfare, take payday loans out, and are registered Democrats.

I'm sorry. I didn't choose it to be that way. Please don't shoot the messenger.

Got a link, Grudz?

http://www.pewtrusts.org/en/multimedia/data-visualizations/2012/payday-lending-in-america

Good study here. Probably the best. Nothing to grudz's claim that I can see.

John Tristan,

Good article. I keep forgetting my google acct. info so by the time, I figure it out, I forgot where I was going to post. The intent of most is good. I think we need more understanding of all the consequences before moving forward. Again, great article.

I fear that on-the-street loan sharking will replace payday lenders if the latter are put out of business. If somebody can convince me otherwise I'd consider supporting this initiative.

John, the bottom half of this infographic shows what PayDay loan customers say they would do if those types of loans were no longer available.

http://www.pewtrusts.org/en/multimedia/data-visualizations/2012/payday-lending-in-america

Here's the front page to the whole group of Pew studies:

http://www.pewtrusts.org/en/projects/small-dollar-loans-research-project/research-and-analysis

Appreciate it, Bill. Consideration of the consequences should be the front burner issue on this one. You've added much to the discussion, both here and at the Constant Commoner. Thanks.

John, there will always be alternatives to almost anything that is elimiated via legislation. We have laws against selling alcohol to minors, but they can still buy it from their friends or older siblings. There are laws against gambling in many areas so people might join in a private poker game or participate in online sports betting. We have anti-smoking laws preventing people from smoking indoors, so bars created "outdoor" areas complete with heaters, roofs, glass paneled walls, and full bar service.

Point is, yes there will always be other ways around a ban and there are always loopholes to any restriction. However it does reduce demand of a product or service, and it does result in a net benefit. Our military figured this out decades ago which is why it is illegal for these places to offer a loan to a servicemember at these outrageous inflated rates.

Does this mean a servicemember can't find another way to pay too much for a loan? Surely not - but it makes it harder, and most simply avoid it. The net result is a positive for society, and it will help some people who don't realize the ramifications of these payday loans until it is too late.

If we refuse to act until there is a mythical way to ensure 100% compliance and where all loopholes and alternatives are considered, we would never act. This is like suggesting we shouldn't have laws requiring prescriptions for medications since we know people can find ways to buy Oxycontin in a back alley somewhere.

Laws aren't perfect. People aren't perfect. We cannot expect a perfect solution in an imperfect world.

Bill, the main problem I see with the study you linked is that is focuses on borrowers' options that are currently available. What it misses is a "fill the void" analysis. Without payday loan store fronts, loan sharks would soon fill that void, giving those in need the very option that John and JenW have identified.

The other problem that seems to concern only me on this thread is that the bill takes away an option for people in need, and basically treats these people as infantile morons unable to make an intelligent decision about whether and when to borrow. That fits squarely into grudz's unfortunate view that people in need are lazy and stupid (and vote for Democrats).

LOL, thanks John, it's an interesting topic to me, so I've been doing some digging. Wasn't sure if my note to your blog was going to go through. I keep getting flummoxed on how I should log in there to comment. My google thingie seems temperamental on certain sites. I'm sure it's google's fault. ;-)

Craig's comment raises yet another potential unintended consequence. Taking away the option to borrow from a payday loan outfit could lead to an increase in theft, burglary or even robbery. When someone is desperate to obtain something needed for their family and there are no lawful sources, turning to crime may be the only rational alternative. So the danger is not only that loan sharks will fill the void, but the loss of the payday loan option could well be the straw that breaks the camel's back and leads to increased crime for those in dire need.

BCB your position is quite similar, if not identical to Troy's actually. I think the study points to policies that would retain some of the good things you cite while eliminating the ability of creditors to do more harm to their clients than good.

"your position is quite similar, if not identical to Troy's"

Bill, that is the reason I thought hell probably froze over or the Vikings won the superbowl! Talk about strange bedfellows. Next thing I know I'll be agreeing with the anti-neo this and that posters.

Sorry, I can't go that far guys. It's too much like the mob saying if they can't run their loan shark business there will be an big uptick in crime. Seems like there has to be a better alternative to solving the problem than to make the loan customers debt slaves and the rest of us afraid of them. Note in the Pew study, most of the customers would like to see the system reformed. Not eliminated, reformed.

Not to worry Bat, I agree with Troy sometimes too. ;-)

When wingnuts tightened bankruptcy laws so it got much harder to file-who did they target?

http://the-spark.net/np747201.html

Here's a clue-those least able to afford usurious interest rates. That's who.

Me too among others like removing option for rebuilding credit rating or being tempted by illegal sources of cash.

Bill, don't get me wrong, I fully support reformation of the payday loan system, but not in a way that destroys that option for those in need. As I suggested in an earlier post, why not establish a loan program through County General Assistance as an alternative for folks facing an emergency. Perhaps legislation that requires payday loan companies to provide potential borrowers a list of alternatives where they can borrow at reasonable rates, such as though County GA, would make sense - disclosure of of options and costs to borrow could inform the consumer, while respecting his or her judgment to decide the course of action that he or she thinks works best.

Yeah, that's why the issue needs some deep study. It could be that a simple interest rate cap isn't a good enough solution. I hope Hickey jumps back in soon and works his way through it with us here. Jumping on Troy for being a bad Catholic didn't exactly cut it for any of us here. LOL

JeniW's analogy to abortion policy gives me shivers and giggles. The shivers come at the implications for consistency of my political positions. The giggles come at the thought of working out a compromise with Troy: Allow payday lenders to continue to exist, but require them to refer all borrowers to financial crisis counselors who will try to talk them out of taking loans at triple-digit interest and impose a 72-hour waiting period, not counting weekends.

What does the unfortunate person do during that waiting period? Try out some options. Craig gets me thinking that maybe we're suffering from a paucity of imagination. Who says a payday loan at highway-robbery rates is the only way to deal with a sudden problem (the basic one we've been assuming is car breaks down, can't get to work)?

1. Ask Mom. PNR (in a good post today that says the cost-benefit research on payday lending remains inconclusive) says one big problem is that lenders can't be the borrowers' parent. I agree. Ask your parents for the money. They'll have a much better shot at holding you accountable and making you make better decisions in the future.

2. Borrow a car, or carpool, or ride your bike, or take the bus.

3. Sleep at the office, or stay with a friend.

4. Talk to the boss. See what you can do to rearrange your work schedule. And offer to put in overtime—good for you and for the company.

5. Drink less beer. Drink no beer.

6. Apply for public assistance.

7. Quit work, stay home, take care of the kids.

8. Drop your cable TV.

Feel free to add your suggestions (at the very least, I'll need them for the financial crisis counseling center I'll start after the Jones–Heidelberger compromise passes this session to deter the Hickey–Hildebrand initiative). Are any of these solutions any more radical or harmful than taking a loan at a 400%?

Payday loan centers and other high interest businesses that lend money have not put the street loan shark out of business, there remains a ready market for their services. The drug culture, people that don't qualify for payday loans, and those that are simply caught in the throes of poverty still utilize street loan sharks.

Wingnuts facillitate making people poor,then want to stop them from receiving welfare. Then they cut taxes so they have to cut gubmint spending which means they go after public assistance with a vengeance leaving the poor,elderly,the military with few options,but, loan sharking is okay if someone makes ungodly amounts of interest off the backs of all the poor wingnuts love so much because they make so many of them.

I believe you, Roger. As per the P$YCLE customer profiles I provided above, and those detailed in the Pew study, the most poverty stricken market segments don't appear to be the primary payday loan clientele.

Here's the summary of key findings and policy recommendations from the recent Pew study.

http://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2013/PewPaydayOverviewandRecommendationspdf.pdf

Bill, I'd say that based on your info, reform is a better route than outright banishment.

Are the banks possibly behind this reform or elimination as they have in the past gone after the credit unions?

John, I agree, but it's probably a harder sell than Hickey's simple interest cap number come voting day. 36% interest sounds like plenty of money. Ah, politics. ;-)