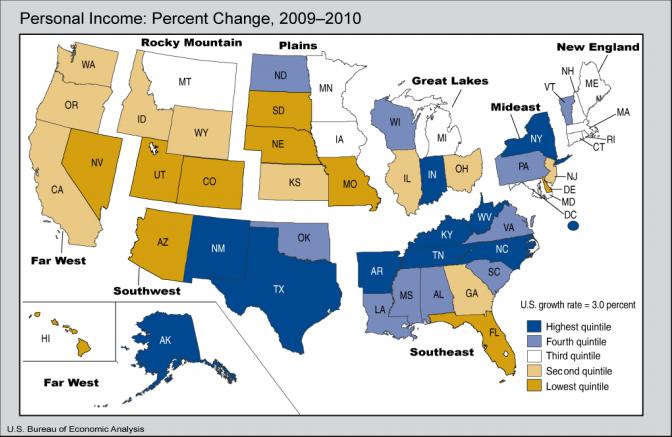

The Bureau of Economic Analysis has tallied personal income by state for 2010. The good news: everybody got richer! Well, every state did. After a really rotten 2009, which brought a 1.7% drop, states saw personal income grow in 2010 by an average of 3.0%.

The kinda-bad news: South Dakota was at the bottom of that heap. Our income grew from $31.2 billion in 2009 to $31.6 billion in 2010. That 1.5% increase was slower growth than anywhere else but Nevada (0.3%). Farm earnings actually took a hard hit, dragging our overall growth down. The same was true of farm earnings in North Dakota. But both South Dakota and North Dakota saw the biggest quarterly gains at harvest time, posting 2.3% and 2.2% personal income growth in Q4 2010, the best gains in the nation.

Perspective: We South Dakotans enjoyed 10.2% personal income growth in 2007 and 8.3% growth in 2008. Our 2010 personal income was still $67 million less than the 2008 peak. We're not in recession, but we're still climbing out of the hole.

Another perspective on how much money South Dakota has: Given $31.6 billion of personal income statewide, a 0.40% income tax—4 pennies on every ten dollars that flowed into South Dakotans' pockets last year—would cover the $127 million that Senator Russell Olson wanted to cut from K-12 education.

1998 2007 2008 2009 2010 werer the only good five years in the last thirty for grain prices. The last two also had real good rain which is rare for South Dakota. So we just had the best two years ever and the last was just slightly better than the one before so we really had the best ever the last two years.

Cory, Where does the 31 billion number come from? How is calculated? Is it the taxable income found on the 10-40? Do we have grasp what the gross income figure would be for SD incuding all sales, salaries, commodity income, interest, dividends, rent etc?

{CAH: Charlie, BEA offers these definitions: "Personal income is the income received by all persons from all sources. Personal income is the sum of net earnings by place of residence, property income, and personal current transfer receipts. Property income is rental income of persons, personal dividend income, and personal interest income. Net earnings is earnings by place of work (the sum of wage and salary disbursements, supplements to wages and salaries, and proprietors’ income) less contributions for government social insurance, plus an adjustment to convert earnings by place of work to a place-of-residence basis. Personal income is measured before the deduction of personal income taxes and other personal taxes and is reported in current dollars (no adjustment is made for price changes)." [emphasis mine]}

Your post fall directly in line with what Charlie Johnson is proposing to fund Education, only using gross dollars instead of net income would allow for a lower percentage and provide the fairness Charlie is looking for.

Maybe I should quit harping on the notion of ditching South Dakota and running off to Wyoming. Maybe I should look at Texas instead! In your last two "state-by-state comparisons," Texas has made a mighty good showing.

No personal income tax there, although they do have a corporate income tax.

They're practically giving away condos in Austin.

As for increasing revenue, if we must do that (and I am not yet convinced), I'd go with a sales-tax increase, and not a new tax.

Any new tax would involve a new bureaucracy, which would eat up some of the revenue thereby gained, and new paperwork for businesses, which would eat up time that they could otherwise spend serving their customers.

I still fail to grasp the notion that taking money out of the pockets of people who already struggle to survive can make them better off. I'm just not getting it.

What good will new roads, better schools, and better services in general do us if, in order to have them, we must live on beans and rice and wear our overcoats indoors?

Stan: careful on Texas. Try New Mexico -- hurricanes don't reach there, do they? :-)

I don't want to beat up the poor with a tax, but I also don't want to beat them up with bad roads and bad schools. it's hard to figure out how best to balance the investment in social services. Luxury tax? Tax on SUVs? Or how about just a straight 7% sales tax on everything, with the state issuing every state resident an annual refund check of $700?

Stan,

A long time ago, when I lived in the Bison-Lemmon metroplex, I attended a cracker-barrel and had the temerity to suggest that SD eliminate the sales tax on food. I was told that people did not have to eat steak; they should eat beans. It's good to see that conservatives are coming to understand that man does not live by beans alone.

Luxury tax? Good idea. Maybe an extra 3 percent on the sales tax.

SUV tax? Depends on the gas mileage. Instead, I'd favor increasing vehicle registration fees for SUVs and pickups (and, as a pickup owner, I can claim immunity from prosecution for hipocrisy.) Or maybe a system something like the one they use in Wyoming, where the fee is based on the blue-book value of the vehicle.

I'd favor eliminating the sales tax on food, and then increasing the general rate just enough to compensate (that is, remain revenue-neutral). Any further increase would depend on the need.

Again, let me clarify: I question the need for any tax increases at this time (or any time). Convincing me might be hard, but not impossible. Keep trying.

We had better be mighty careful about advocating tax increases at a time like this, lest we find ourselves on the wrong side of the Laffer curve.

By the way, I have tried to live on a diet with lots of beans and rice and grains instead of meat; in theory it makes sense. Unfortunately, my body cannot thrive on such a regime. Believe me, I gave it my best Republican try, and I simply failed. The stuff went through me like gravel. It was back to the carnivorous way, or else shrivel up and blow away.

Well, Stan, at least no one can ever say you're full of beans.

Fees based on Blue Book? I should look that up! Car dealers must hate that.

Another typo on my part: "hipocrisy." Well, that variant of "hypocrisy" could have a neat twist in these brave new times. Palinism or Gibiliscofication, what's the difference?

In regards to car fees based on the blue-book value, it seems like every other huge, shiny, brand new pickup that passes me on I-90 between Rapid City and Sturgis at 85 mph has Wyoming plates. Of course, those are the rich folks; I get skewed data.

Apparently our eastern neighbor MN has a bigger deficit than SD, even though it has an income tax, and education is complaining there too that it just doesn't have enough money. Seems to refute the idea that a state income tax would solve all our problems. All gov'ts spend too much money, period. It hurts when we have to cut our household budgets, and it hurts when gov'ts have to live within their means. But simply asking for higher taxes is NOT the answer.

But Linda, it doesn't refute the idea that if you need money to perform basic functions, you have to get that money somewhere. State income taxes don't cause bigger deficits: irreponsible legislators and bad economic turns cause deficits.

My point is that state income taxes do not solve the problem of education funding, period!

Maybe they do, maybe they don't. My point (and the point of a lot of educators) is that if we need money to get the job done, we need to get the money, and a tax on income that we apparently have more of is one reasonable place to turn to get that revenue. Whether we use it wisely once we get it is another question... a question of electing serious school board members who know their public policy!

Careful, Cory, you are beginning to sound like SHS at the debate last fall at the Sioux Empire State Fair, which left me and others with our jaws dropping. She essentially stated that the fed gov't deserved the money from an estate tax, that it really was rightfully theirs; how else would they ever pay off their huge national debt?? Oh, really?! How about less spending and better use of the tax dollars you already receive.

Linda, I promise (famous last words!) that I'll do everything I can to make sure every tax dollar is used wisely. but that doesn't preclude the possibility that to do certain necessary things (ADA compliance, electrical upgrades, competitive wages), we might need more dollars. I don't just want more money for more money's sake. If we can get by with the dollars we have (or less), then so be it. But I am as open to cutting taxes when we don't need the money as I am to raising taxes when we do need the money.

Looks like the debate here boils down to how much we want government to provide for us, versus how much we want to fend for ourselves: "public sector" versus "private sector."

I've often joked that Republicans favor letting us get ripped off by big corporations, while the Democrats favor letting us get ripped off by big government.

Maybe it's not a joke.

I wholeheartedly agree with Stan's observation about the two parties. What frightens me is that big government and big corporations are becoming cronies rather than competitors. I really worry that we're going to reach a point where it will be impossible to distinguish between corporate policy and government policy.

If 4 tenths of one percent on net personal earnings will generate 127 million(10% state revenue shortfall), a much smaller rate on gross receipts/income with no exemptions or thresholds should fully fund the school aid formula plus. By doing so we eliminate property taxes for general fund use(44% of the school aid formula) and millions of state dollars(56% that comes from state general fund aka sales tax). We cover the obligation for school aid formula thus providing property tax relief on the local level and budget relief for taxpayers on the state level. Plus every SD resident gets to participate(has "skin in the game") from the teenager making his first dollar flipping hamburgers to the executive making six figures to the farmer selling his grain. If we can't provide for k-12 education by providing less than one half of one percent of our income plus having the benefit of property tax relief and be comfortable with that, then something doesn't speak well of our priorities.