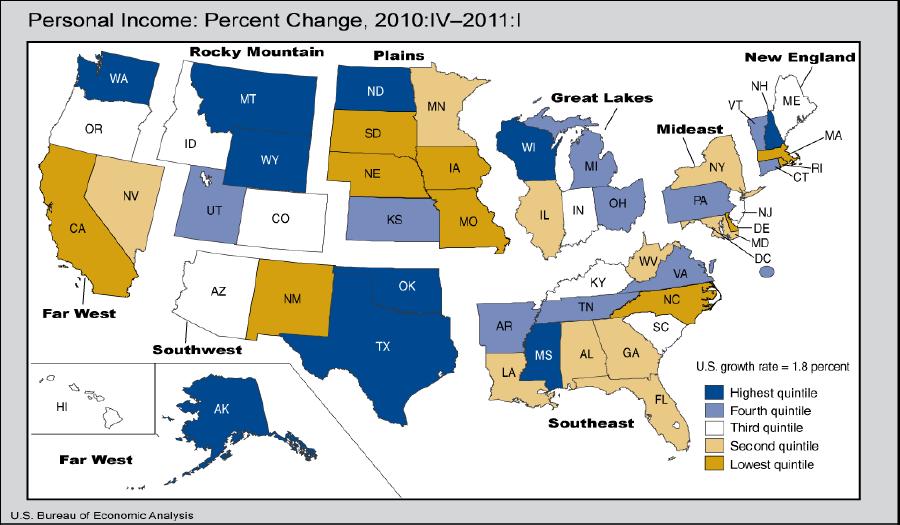

South Dakotans made made more money in the first three months of this year, but not much. New Bureau of Economic Analysis data says South Dakota's state personal income increased by 0.8% in the first quarter of 2011 compared to Q4 2010. That's the second-lowest growth rate in the nation, ahead of only Iowa at 0.7%. National personal income growth was 1.8%.

The booming-est states: North Dakota, Wyoming, Texas, and Montana (Larry! Send cash!).

BEA notes that most of the income boost came not from increased hiring, productivity, or pay raises, but from the one-year two-percentage-point reduction in FICA payroll taxes provided by the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010.

This part of the big year-end tax/stimulus deal won praise as a break for Main Street, not Wall Street... unlike the Bush tax cuts that President Obama extended in this same legislation. Unfortunately, the FICA rollback may have set the stage for even faster dismantling of Social Security and worse income inequality.

Whatever the merits of the mechanism, consider that without the FICA rollback of two percentage points, South Dakota's income growth last quarter might have been negative. Add in the impacts of laying off teachers and state budget cuts that kick in next week, and South Dakota's 2011 economic numbers may get worse.

Hmm South Dakota take notice of ND and WY and explore your oil drilling options in western South Dakota

Wish i could say it was all good for the Earth, Cory. Coal, sprawl, landfill waste, encroachment on wildlife habitat. Good thing Democrats still run state government. Mine cleanup alone could generate even more jobs. Rebuilding from flood damage will spike here; South Dakota, too.

Education is a bigger deal in Montana than it is in South Dakota; here the tribes have embraced more cooperation with the university systems. Having two Democratic senators has its rewards for sure.

Off topic: even if the corps would have released earlier they would be dumping at these levels by now anyway. The politics of Spring Pulse have made them gun-shy about hydropower and barge traffic. They have done a lot with the aging pieces of crap passing for flood control on the Missouri. The dams should go away.

This just out: http://missoulanews.bigskypress.com/IndyBlog/archives/2011/06/22/poll-tester-popular-but-trailing-rehberg

[CAH: Let's keep it on topic, please!]

At least we South Dakotans can say we beat Iowa. For what it's worth, let's keep allowing illegal immigration and beef up right-to-work.

Let's see ... 10 states in dark blue (highest growth) ... and five of them lack personal income taxes (Washington, Alaska, Texas, Wyoming, and New Hampshire). In addition, I believe that Montana, New Hampshire, and Alaska lack sales taxes at the state level. Of the relatively high-tax states, only Wisconsin seems to stand out as having done particularly well.

Of course this data represents a narrow sample of a rather narrowly defined specification. I do wonder, however, why our own South Dakota did so poorly while all three of our freedom-loving neighbor states (Wyoming, Montana, North Dakota) did so well?

For this to be relevant, we have to know how we have historically done from 4Q of one year to the 1Q of the next. Considering SD farm income can skew short-term data (especially since farmers choose to generate income in either of these two quarters depending on their tax situation, fluctuations during these quarters could be meaningless.

So, if you were to take out the effect of agriculture, the growth would be 1.5% (which is in the middle for the nation). And if you adjust for the seasonality of our construction, SD is one of the best in the nation.

I only looked at the past three years, but our flattest quarter over this period was comparing 4Q of one year to 1Q of the next year. There is no news here. Furthermore, the speculation in the last paragraph is flat unsupported by the data when looked at in context.

Cory, if you are going to make statements using statistics, dig deeper to understand the statistics. You might find the real story behind the numbers is contrary to your primary premise.

However, what is significant though is from 2009 to 2010, SD experienced 5% growth (

No, there is news here, Troy. The speculation in the last paragraph finds support in Bob Mercer's report that state tax revenues are lower than expected.

I will grant that, historically, your observation on Q1 growth is correct. Looking at quarterly growth back to 1948 (the oldest data available from BEA, South Dakota's Q1 personal income growth is 1.06%, below the national average of 1.63%, and ranks 47th among the states. Average Q2 growth is even lower, ranking 49th. Q3 average is 1.52%; We cash in in Q4 with 2.45% growth.

Historically we've underperformed the national personal income quarterly growth rate. Since 1948, SD"s average has been 1.52%. The national average has been 1.67%. We've outperformed Iowa and Nebraska, but not Minnesota, North Dakota, Montana, and Wyoming.

We have done better in the last decade, since Q1 2001, with average quarterly income growth of 1.21%. National average over same period: 0.98%. In the last decade, we've beaten MN, IA, and NE, but ND, MT, and WY stay ahead (oil and coal, right?).

Everybody's growth rate over the last ten years is lower than the historical average. Nationally, income growth has been below the historical average since 1973. Q1 2011 was the first time since 1973 that the national average personal income growth exceeded the historical average.

Cory, there is news or information in context for a rational discussion in your last point. My only point is the inherent anamolies in the South Dakota economy (distribution of farm income, construction season ends in the 4Q and is negligible in the 1Q) makes trying to make any meaningful inference from the data you used is impossible. T

Troy, you continue to inspire me to numerical analysis. Let's make some meaningful inferences possible.

Historically, South Dakota does have one of the biggest negative deviations in Q1 income growth from annual average in the union. We rank 48th in that category. Montana, the District of Columbia and North Dakota have even greater dips in Q1 income growth from their annual averages. New York, Ohio, and Kansas also have remarkably negative historical Q1 deviations from their average annual growth.

South Dakota's 2011 Q1 income growth rate was even lower than our low historical average. Historically, we average +1.065% in Q1. This year we only grew +0.845%. We underperformed our usual Q1 underperformance. The six other slow-Q1 places I mentioned above all beat their historical Q1 average growth rates:

---DC: 2.009% (hist. avg. 0.902%)

---Kansas: 1.876% (avg. 1.345%)

---Montana: 2.583% (avg. 1.071%)

---New York: 1.736% (avg. 1.205%)

---North Dakota: 6.876% (avg. 0.592%)

---Ohio: 1.868% (avg. 1.270%)

Notice that those six places all also beat the national historical average Q1 growth rate of 1.630%. All but New York beat the national 2011 Q1 growth rate of 1.800%. Our low 2011 Q1 income growth is anamolous even among our usual fellow anamolies.

32 states beat their Q1 historical growth averages this year. The nation as a whole beat its Q1 growth average. Of the eight regions shown in the BEA map above, six beat their Q1 averages. The Southeast and the Far West underperformed. North Dakota probably carried our Plains region, as Minnesota and Iowa also underperformed in Q1 growth

Now I'll admit, this analysis may be flawed by looking at historical averages back to 1948, over which period economic patterns may have changed. One might argue that we would get a better picture of current performance by looking at more recent data only (last 20 years?) that better reflects current economic activity. I also haven't done any standard deviation or confidence-interval monkey business.

But looking at the numbers as you've suggested, Troy, seems to support the inference I offered at the top: Even when we account for historical quarterly income patterns, South Dakota's economic performance in Q1 lagged the national economy and could portend ill for our state revenue situation.

First, I am impressed a non-math mind delved in so deeply.

Second, the deviation you noticed could portend a trend. But it would require a lot more analysis. For instance, you need to study how many times this performance did give a window in the future and discount seasonal, tax motivated shifts, and agriculture anomalies (both yield and price impact) from past and current info to be normalized from which to make an informed guess.

But again, you did good work by going so far back. Better than looking at just a few years. I think if you were to look at this same info next quarter, making an inference from that data might need less normalization and be more reliable.

Let's have this conversation then. Dont get me wrong. You did good work. Just picked the hardest period to analyze.

Non-math mind? B.A. Math/History, SDSU, 1994. And you've obviously never seen me work a spreadsheet.

Agreed: we need to take this same look at the next quarter's data, and the next.